– Healthcare Growth Partners’ (HGP) summary of Health IT/digital health mergers & acquisition (M&A) activity, and public company performance during the month of August 2020.

M&A is back and the velocity of the rebound has outpaced all expectations. The recovery quickly worked its way across the spectrum from large to small-cap, beginning with the larger cap NASDAQ rally of nearly 80% from lows in late March (only to soften in recent days), followed by multi-billion dollar recapitalizations of the likes of WellSky, QGenda, and Edifecs, thereafter a wave of large-cap M&A, including Teladoc-Livongo and Waystar-eSolutions, and capped off by a resurgence of small-cap M&A transactions. Taken together, the pace of Health IT M&A and Buyout transactions during the months of June through August is exceeding that of 2019 at an ever-increasing rate. Based on our own experience of deal activity, we see this acceleration continuing through the rest of the year. A flood of capital, rock bottom interest rates, looming tax hikes, a reinforced digital health investment thesis, and the proven resiliency of the recession-proof healthcare system results in strong fundamentals for health IT, notwithstanding the precarious macroeconomic picture.

Noteworthy News Headlines

- HHS’ chief information officer, José Arrieta, resigned unexpectedly August 14. He departs just four months after the department stood up the public data sharing hub HHS Protect, and a little over a year since he took over as chief information officer.

- GoodRx, a company that helps consumers access prescription drugs at a discount, filed to go public on August 28. GoodRx has one thing these other fast-growing companies do not: A record of consistent profitability. According to the filing, the company earned $55 million in profit for first half of 2020, up from $31 million in the first half of 2019 — a jump of 75%. Revenues for the first half of 2020 were $257 million, up from $173 million in the first half of 2019, for growth of 48%.

- President Trump is expanding access to telehealth services and ensuring continued access to healthcare for rural americans.

- R1 RCM, one of the nation’s largest medical debt collection companies, has been hit in a ransomware attack.

- Epic Systems is now allowing its thousands of employees the option to continue working from home through the end of 2020. The move is a reversal from a plan that would have begun a phased return to in-person work for many of the company’s approximately 10,000 employees in late August. It comes after many employees publicly pushed back against the plan over concerns it was arbitrary and could jeopardize their health and the health of the community during the COVID-19 pandemic.

- Virginia has rolled out a smartphone app to automatically notify people if they might have been exposed to the coronavirus, becoming the first U.S. state to use new pandemic technology created by Apple and Google.

Noteworthy Transactions

Noteworthy M&A transactions during the month include:

- Genex finalized the acquisition of Coventry Workers’ Comp Services, provider of care and cost management programs for workers’ compensation, for $850 million.

- Teladoc and Livongo announced a merger agreement in a deal valued at $18.5 billion. This combination will create a health technology giant as the demand for virtual care soars.

- Limelight Health, provider of quoting, rating, and underwriting solutions for group and voluntary employee benefits, was acquired by FINEOS for $75 million.

- Health Catalyst announced an agreement to aquire Vitalware, provider of revenue workflow optimization and analytics SaaS technology solutions, for $120 million, representing a multiple of 6x revenue.

- Waystar announced a definitive agreement to acquire eSolutions, a revenue cycle technology company with unique Medicare-specific solutions. The acquisition values eSolutions at $1.35 billion and will create a platform combining commercial and government payers onto a single payments platform.

- Omnicell announced an agreement to acquire Pharmaceutical Strategy Group for $225 million, expanding the pharmacy supply chain capabilities for efficient, compliant management of 340B programs.

- Qualifacts, EHR provider for behavioral health, and Credible Behavioral Health, software firm that works with clinical, community, residential and mobile care providers, agreed to merge.

- Bayer agreed to acquire personalized vitamin company Care/of at a valuation of $225 million.

Noteworthy Buyout transactions during the month include:

- Clinical Ink, clinical trial technology company, announced its acquisition by GI Partners.

- Blackstone Group agreed to acquire genealogy provider Ancestry.com for $4.7 biliion, placing a big bet on family-tree chasing and personalized medicine.

- Rethink First, provider of cloud-based software solutions, assessments, and clinical best practice content for supporting individuals with autism ad other disabilities, announced a strategic investment from K1 Investment Managamenet.

- Reliance Industries announced the acquisition of a majority stake in Netmeds, licensed e-pharma portal that offers authenticaed prescription and OTC medicine in India, for $83 million.

Noteworthy Investments during the month include:

- Lumeon, provider of care pathway management patform, raised $30mm in a Series D funding led by Optum Ventures and Endeavour Vision.

- Provider of healthcare crowdfunding mutual aid insurance platform Waterdrop, raised $230 million in a Series D led by Tencent and Swiss Re Group, valuing the company at $2 billion.

- Atomwise, a company that deciphers human disease via the largest AI-drug discovery portfolio, announced it closed on $123 million in an oversubscribed Series B led by B Capital Group and Sanabil Investments.

- THREAD, developer of a remote patient research platform designed to conduct clinical trials and virtual trials, raised $50 million from JLL Partners and Water Street.

- Axioma Ventures invested $25.5 million in Bridge Connector, an interoperability company designed to revolutionize the way healthcare systems communicate with each other.

- Thirty Madison, provider of online health portals for treatment of chronic conditions, raised $47 million in a Series B round led by Polaris Partners.

- Science 37 raised $40 million in a round led by Lux Capital, Redmile Group, and PPD, Inc, to extend its leadership in the decentralized clinical trial market.

- Telehealth company Amwell announced it is going public and will receive $100 million from Google.

- Digital health benefits platform, Lyra Health, raised $110 million in its Series D led by Adams Street Partners, valuing the company at $1.1 billion.

- PatientPop, provider of marketing tools for medical practices, announced it secured a Series C round of $50 million, led by HLM Venture Partners.

Public Company Performance

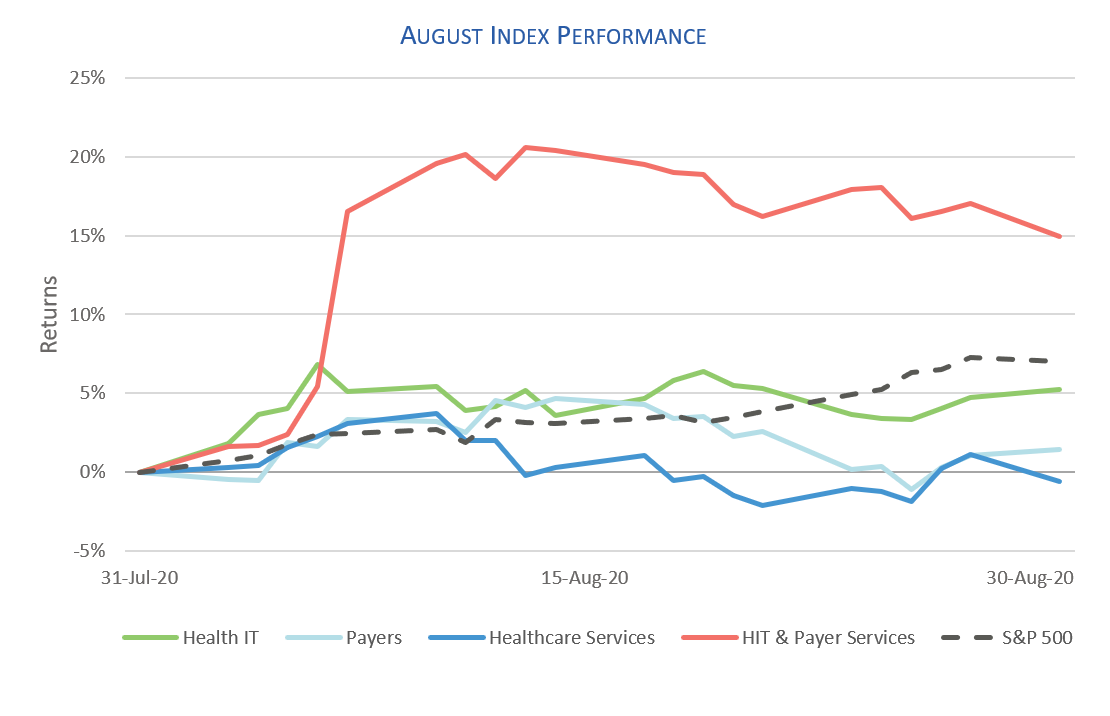

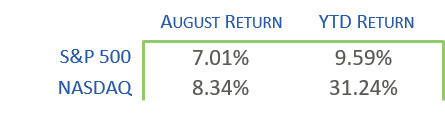

HGP tracks stock indices for publicly traded health IT companies within four different sectors – Health IT, Payers, Healthcare Services, and Health IT & Payer Services. Notably, GoodRx, a platform that helps consumer find affordable prescription drugs, filed for an IPO. SOC Telemed and Accountable Healthcare America also announced plans to go public via reverse mergers. The chart below summarizes the performance of these sectors compared to the S&P 500 for the month of August:

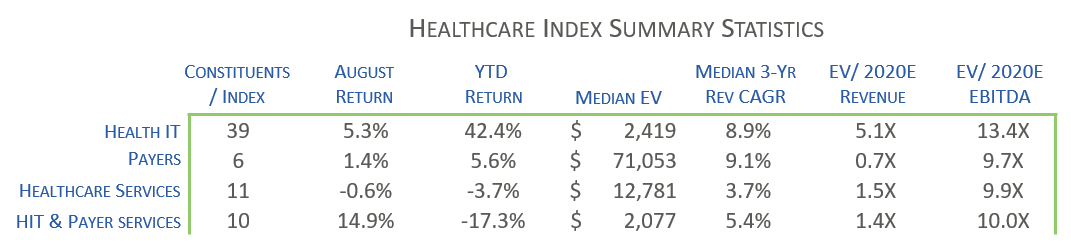

The following table includes summary statistics on the four sectors tracked by HGP for August 2020:

About Healthcare Growth Partners (HGP)

Healthcare Growth Partners (HGP) is a Houston, TX-based Investment Banking & Strategic Advisory firm exclusively focused on the transformational Health IT market. The firm provides Sell-Side Advisory, Buy-Side Advisory, Capital Advisory, and Pre-Transaction Growth Strategy services, functioning as the exclusive investment banking advisor to over 100 health IT transactions representing over $2 billion in value since 2007.