– Healthcare Growth Partners’ (HGP) summary of Health IT/digital health mergers & acquisition (M&A) activity, and public company performance during the month of November 2019

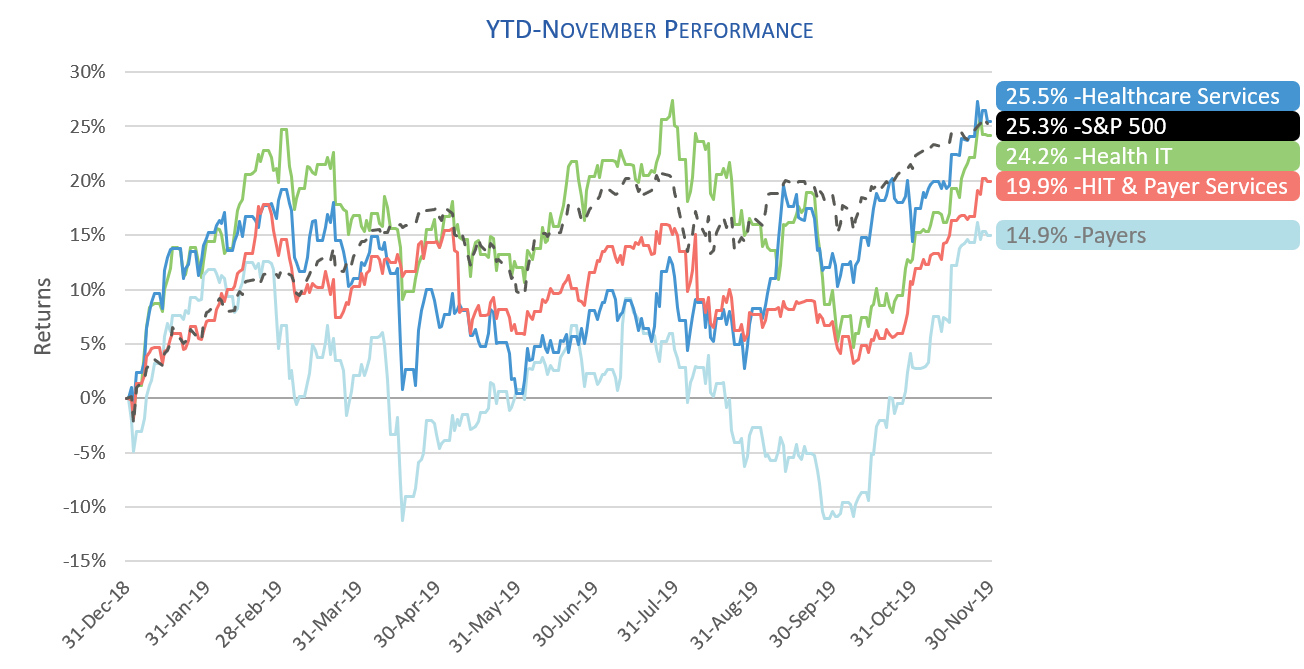

We did a doubletake when we noticed all of the HGP healthcare indices climbed approximately 10% during the month of November. Year-to-date, the S&P 500 is up over 25% and the HGP healthcare indices are all hovering in that range. In the two month period since September, when talk of universal healthcare reached its peak in the recent election cycle, the HGP Payer Index climbed over 25%. If it feels like valuations are up this year, it’s because they are.

Some valuations, including those of Teladoc and Veeva, and recent IPOs of Phreesia and Health Catalyst, are up over 50%. It goes to show that valuation is as much about sentiment as metrics. Sentiment, and the markets are at an all-time high. More news and transaction highlights from the month of November are as follows.

Noteworthy M&A Transactions

Noteworthy M&A transactions during the month include:

– HMS Holdings acquired Accent from Intrado Corporation (formerly known as West Corporation) for approximately $155mm. The acquisition extends HMS further into the coordination of benefits across both Medicare and commercial payers.

– Health Prime acquired Kareo’s Managed Billing businesses, creating a combined operating entity that will provide RCM services to more than 2,500 physicians across the United States.

– Biofourmis acquired Switzerland-based Biovotion AG, enabling Biofourmis to offer clinical-grade wearables as part of its Biovitals ecosystem.

– NextGen Healthcare agreed to acquire Medfusion for a total purchase price of $43 million. The Medfusion Patient Experience Platform includes patient intake, patient scheduling, and payment capabilities used by more than 16 million patients today.

– Invitae agreed to acquire Clear Genetics. Using chatbots, Clear Genetics equips patients with actionable information throughout the genetic testing process and provides guidance for understanding test results.

– Censis has been acquired by Fortive Corporation. Censis will work closely with Advanced Sterilization Products, another Fortive company, to tackle a combined mission of patient safety.

Noteworthy Buyout Transactions

Noteworthy buyout transactions during the month include:

– Renovus Capital Partners recapitalized ClinicalMind, a provider of medical communications technology and expertise to translate science to reflect its clinical, economic, and societal value.

– NextGen Growth Partners invested in Record Connect, a provider of release of information services to hospitals, clinics, and physician offices across the Midwest.

– Trilliant Health received a major growth investment from Primus Capital. The company provides analytics that empowers healthcare providers to create and execute data-driven strategies to maximize revenue and market share growth.

– Leonard Green and Partners leads recapitalization of WCG in partnership with Arsenal Capital Partners. WCG provides solutions that measurably improve the quality and efficiency of clinical research.

– Brighton Park Capital acquired a majority stake in Relatient, a provider of digital outreach and mobile access in the rapidly growing patient engagement space.

– Apax Partners acquired Lexitas, a litigation services provider focused on deposition and records retrieval services for law firms, insurers, and corporate legal departments.

– EDCO Health Information Solutions was acquired by BV Investment Partners. EDCO provides automated unstructured data indexing solutions for healthcare providers.

Noteworthy Investment Funding

Noteworthy investment transactions during the month include:

– Deep 6 AI raised $17 million in Series A funding led by Point72 Ventures to accelerate clinical trials through improved patient recruitment and trial design. GSR Ventures and other investors also participated in the round.

– Nines, an AI-driven tele-radiology platform, unveiled its software platform alongside news of a $16.5 million Series A led by Accel and 8VC.

– Rightway Healthcare secured $20 million in Series B Funding led by Thrive Capital. The financing will be used to expand Rightway’s healthcare navigation platform and explore new opportunities to deliver its products.

– Wellframe closed a $20 million Series C led by BlueCross BlueShield Venture Partners with participation from several Wellframe clients and existing investors Threshold Ventures and F-Prime Capital. The company offers digital health management solutions for health plans, providers, and individuals.

– Enlitic received $25 million in Series B-1 financing led by Thorney Investment Group with participation from existing investors. Enlitic will use the proceeds to build-upon its artificial intelligence decision support platform.

– Whoop raised a $55 million Series D led by the Foundry Group to expand its activity-tracking wearables business.

– AiCure raised $24.5 million in Series C funding led by Palisades Growth Capital. The company will use the investment to advance research-grade data insights for life science companies.

– Eight Sleep, a maker of high-tech mattresses and sleep products, raised $40 million of growth funding led by Founders Fund and joined by Khosla Ventures, Y Combinator, and others.

– PathAI received a strategic investment from Merck Global Health Innovation Fund and Bristol-Myers Squibb to complete a $75 million Series B. The company provides artificial intelligence-powered technology for advancing pathology research.

Noteworthy News Headlines

– Walgreens Reportedly Explores Going Private in What Could Be the Largest LBO in History. Shares of Walgreens have slid about 22% over the past 12 months, however still has a market capitalization of roughly $55 billion. Reuters reported that Walgreens is working with investment bank Evercore to explore the deal opportunity.

– Google’s ‘Project Nightingale’ Gathers Personal Health Data on Millions of Americans. The Wall Street Journal broke the news that Google, through a commercial partnership with Ascension, had collected millions of patient records and personal health information across 21 states without notifying patients. In response to the news, the Department of Health and Human Services’ Office for Civil Rights launched a probe to learn more with respect to the implications for patient privacy under HIPAA.

– TytoHome Telemedicine Devices Available for Sale at Best Buy Nationwide. The TytoHome telehealth all-in-one modular device and telehealth platform rolled out across over 300 Best Buy stores nationwide – offering consumers across the country the ability to replicate an in-person doctor visit from the comfort of home.

– Trump Administration Announces Historic Price Transparency Requirements. The proposed rule, “Transparency in Coverage,” would require most employer-based group health plans and health insurance issuers offering group and individual coverage to disclose the price and cost-sharing information to participants, beneficiaries, and enrollees upfront.

– 110 Nursing Homes Cut Off from Health Records in Ransomware Attack. Nursing home IT vendor Virtual Care Provider was the victim of a ransomware attack that affected approximately 80,000 PCs and servers across hundreds of nursing homes in 45 states.

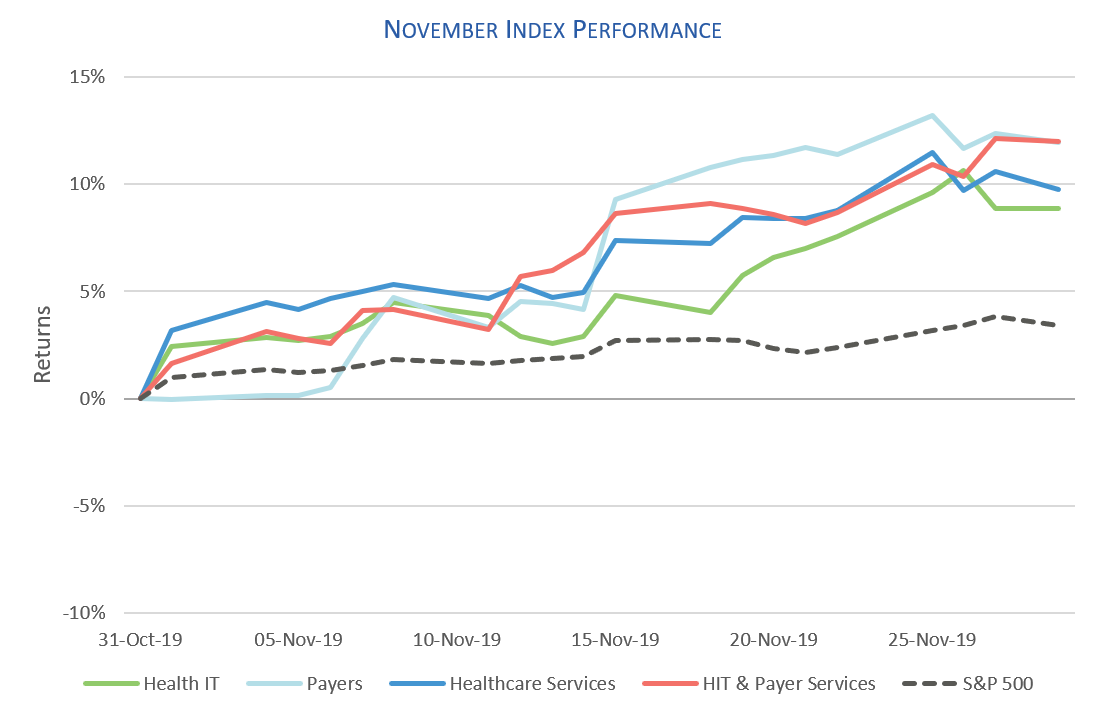

Public Company Performance

HGP tracks stock indices for publicly traded health IT companies within four different sectors – Health IT, Payers, Healthcare Services, and Health IT & Payer Services. The chart below summarizes the performance of these sectors compared to the S&P 500 for the month of November:

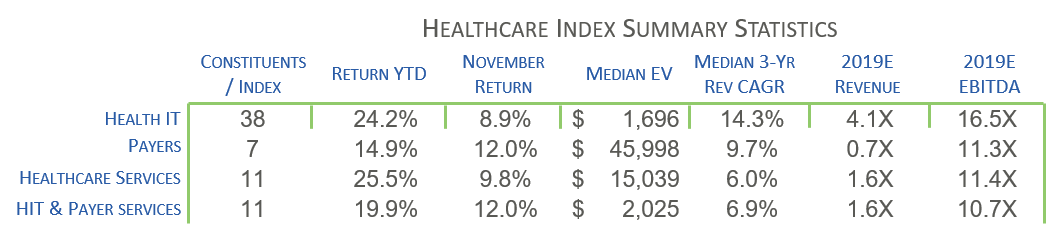

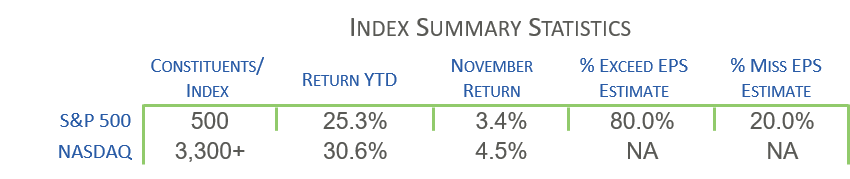

The following tables include summary statistics on the four sectors tracked by HGP as well as the S&P 500 and NASDAQ for November 2019:

About Healthcare Growth Partners (HGP)

Healthcare Growth Partners (HGP) is a Houston, TX-based Investment Banking & Strategic Advisory firm exclusively focused on the transformational Health IT market. The firm provides Sell-Side Advisory, Buy-Side Advisory, Capital Advisory, and Pre-Transaction Growth Strategy services, functioning as the exclusive investment banking advisor to over 100 health IT transactions representing over $2 billion in value since 2007.