– Healthcare Growth Partners’ (HGP) summary of Health IT/digital health mergers & acquisition (M&A) activity, and public company performance during the month of July 2020.

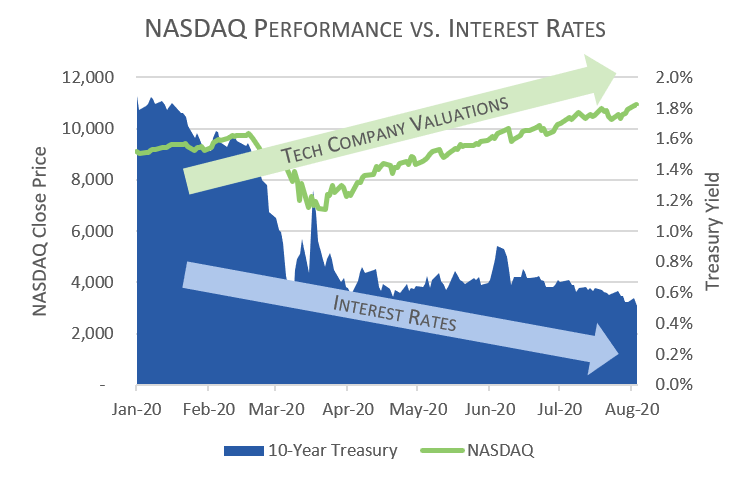

While a pandemic ravages the country, technology valuations are soaring. The Nasdaq hit an all-time high during the month of July, sailing through the 10,000 mark to post YTD gains of nearly 20%, representing a 56% increase off the low water mark on March 23. More notably, the Nasdaq has outperformed the S&P 500 (including the lift the S&P has received from FANMAG stocks – Facebook, Amazon, Netflix, Microsoft, Apple, Google) by nearly 20% YTD.

At HGP, we focus on private company transactions, but there is a close connection between public company and private company valuations. While the intuitive reaction is to feel that companies should be discounted due to COVID’s business disruption and associated economic hardships facing the country, the data and the markets tell a different story.

While technology is undoubtedly hot right now given the thesis that adoption and value will increase during these virtual times, the other more important factor lifting public markets is interest rates. According to July 19 research from Goldman Sachs,

“Importantly, it is the very low level of interest rates that justifies current valuations. The S&P 500 is within 4% of the all-time high it reached on February 19th, yet since that time the level of S&P 500 earnings expected in 2021 has been pushed forward to 2022. The decline in interest rates bridges that gap.”

Additionally, Goldman Sachs analysts also estimate that equities will deliver an annual return of 6% over the next 10-years, lower than the long-term return of 8%. Future value has been priced into present value, and returns are diminished because the relative return over interest rates is what ultimately matters, not the absolute return. In short, equity valuations are high because interest rates are low.

What happens in public equities usually finds its way into private equity. To note, multiple large private health IT companies including WellSky, QGenda, and Edifecs, have achieved 20x+ EBITDA transactions based on this same phenomenon. From the perspective of HGP, this should also translate to higher valuations for private companies at the lower end of the market. As investors across all asset classes experience reduced returns requirements due to low interest rates, present values increase across both investment and M&A transactions.

As with everything in the COVID environment, it is difficult to make predictions with certainty. Because the stimulus has caused US debt as a percentage of GDP to explode, there is an extremely strong motivation to keep long-term interest rates low. For this reason, we believe interest rates will remain low for the foreseeable future. Time will tell whether this is sustainable, but early indications are positive.

Noteworthy News Headlines

- A $10.2 million “sole source” contract to run a centralized Covid-19 database for the Trump administration drew sharp criticism from congressional Democrats, who demanded that the federal Centers for Disease Control and Prevention be reinstated as the primary repository of coronavirus data. The contract drew scant public attention when it was awarded in April to TeleTracking Technologies, a Pittsburgh company whose core business is helping hospitals manage the flow of patients. But it drew scrutiny after the administration ordered hospitals, beginning on Wednesday, to report coronavirus information, including bed availability, to the new database, housed at the Department of Health and Human Services in Washington, instead of to the C.D.C.

- With the CDC sidelines, some states lose access to timely COVID-19 hospital data. Just as the number of people hospitalized for COVID-19 approaches new highs in some parts of the country, hospital data in Kansas and Missouri is suddenly incomplete or missing. Earlier this week, the Trump administration directed hospitals to change how they report data to the federal government and how that data will be made available. Missouri Hospital Association spokesperson Dave Dillon called the move “a major disruption.”

- Hospital giant ACA makes $822 million profit off CARES Act stimulus money. HCA’s biggest profit driver and boost to surviving the pandemic and the influx of Covid-19 patients in the second quarter came from the federal government. In HCA’s second quarter, the government stimulus passed by Congress and signed into law by President Donald Trump turned into a windfall as of the end of the second quarter.

- Hims Inc, a U.S. online provider of mens’ healthcare and consumer products ranging from hair loss treatments to Viagra, is exploring going public through a merger with a blank-check acquisition company that could value it at more than $1 billion, according to people familiar with the matter.

- HIMSS pushes back 2021 conference to August. HIMSS canceled its 2020 global health conference in March just days before it was slated to start due to concerns about COVID-19. HIMSS officials are planning a press conference Friday to offer more details about the HIMSS21 conference.

Noteworthy Transactions

Noteworthy M&A transactions during the month include:

- Workflow optimization software vendor HealthFinch was acquired by Health Catalyst for $40mm.

- Sarnova completed simultaneous acquisition and merger of R1 EMS and Digitech.

- Payment integrity vendor The Burgess Group acquired by HealthEdge Software.

- Ciox acquired biomedical NLP vendor, Medal, to support its clinical data research initiatives.

- Allscripts divests EPSi to Roper for $365mm, equaling 7.5x and 18.5x TTM revenue and EBITDA, respectively.

Noteworthy Buyout transactions during the month include:

- HealthEZ, a vendor of TPA plans, was acquired by Abry Partners.

- As part of a broader wave of blank check go-public transactions, MultiPlan will join the public markets as part of Churchill Capital Corp III.

- Also as part of a wave of private equity club deals, WellSky partially recapped with TPG and Leonard Greenin a rumored $3B transaction valuing the company at 20x EBITDA.

- Edifecs partnered with TA Associates and Francisco Partners in another club deal valuing the company at a rumored $1.4B (excluding $400mm earnout) at over 8x revenue and 18x EBITDA.

- Madison Dearborn announced a $410mm take private of insurance technology vendor Benefytt.

- Nuvem Health, a provider of pharmacy claims software, was acquired by Parthenon Capital.

Noteworthy Investments during the month include:

- Doctor on Demand, a telemedicine vendor, raised $75mm led by General Atlantic.

- Truepill, an on-demand pharmacy, raised $25mm from investors including Optum Ventures.

- VillageMD, a primary care provider, took a $275mm investment from Walgreens and others.

- Medly Pharmacy, an online pharmacy, received a $100mm investment led by Volition and Greycroft.

- Forcura, a vendor of post-acute software, received a growth investment from Accel-KKR.

- Preventice, a developer of mobile health applications, received a $137mm Series B with a host of strategic investors.

- Ro (fka Roman), a cloud consumer pharmacy, received a $200mm investment valuing the company at $1.5B.

- Sema4, a big data genomics company, raised $121mm led by BlackRock valuing the company at $1B.

- Heal, a physician house call company, raised $100mm from Humana.

- Tempo, developer of smart at-home fitness platforms, raised $60mm.

Public Company Performance

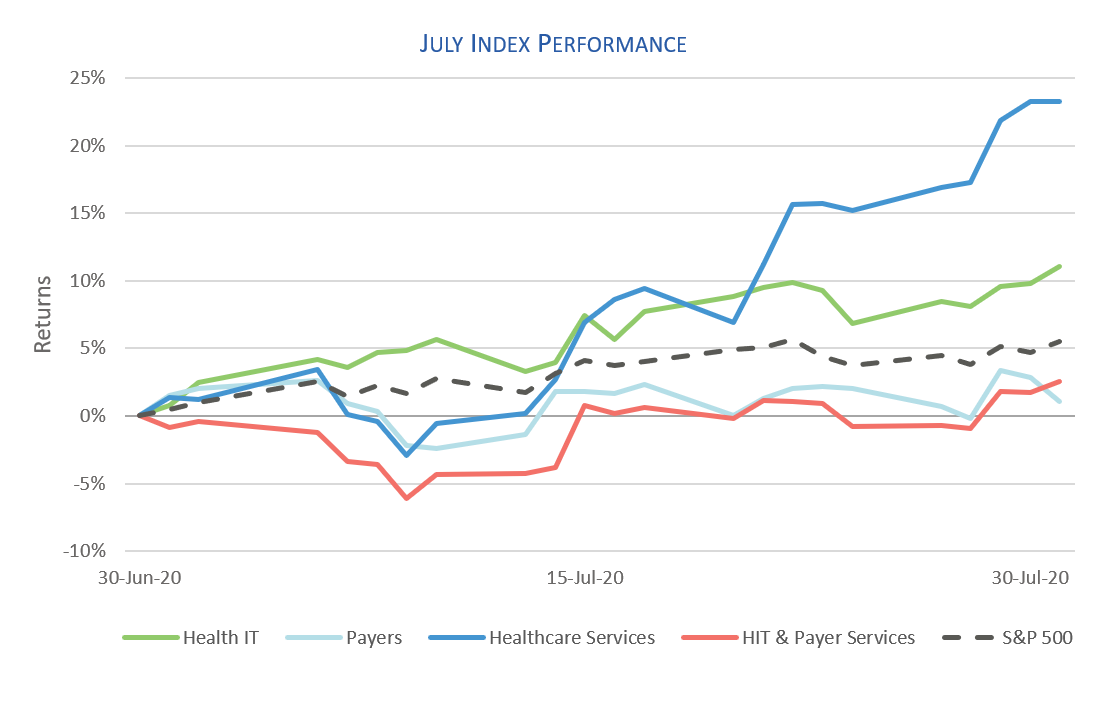

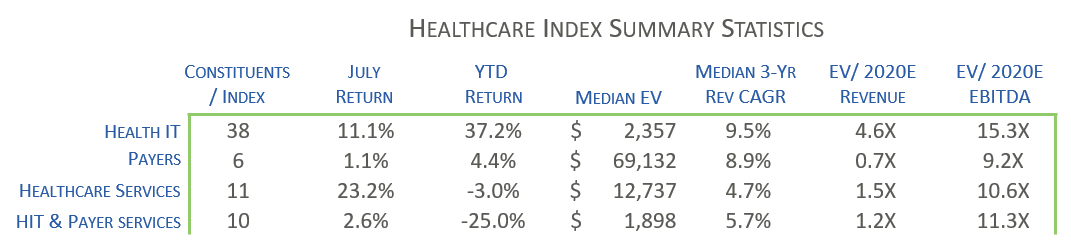

HGP tracks stock indices for publicly traded health IT companies within four different sectors – Health IT, Payers, Healthcare Services, and Health IT & Payer Services. Notably, primary care provider Oak Street Health filed for an IPO, offering 15.6 million shares at a target price of $21/ share. The chart below summarizes the performance of these sectors compared to the S&P 500 for the month of July:

The following table includes summary statistics on the four sectors tracked by HGP for July 2020:

About Healthcare Growth Partners (HGP)

Healthcare Growth Partners (HGP) is a Houston, TX-based Investment Banking & Strategic Advisory firm exclusively focused on the transformational Health IT market. The firm provides Sell-Side Advisory, Buy-Side Advisory, Capital Advisory, and Pre-Transaction Growth Strategy services, functioning as the exclusive investment banking advisor to over 100 health IT transactions representing over $2 billion in value since 2007.