- Seattle-based health IT innovator Twistle raises $16M in Series A funding from two major healthcare investors: Health Enterprise Partners (HEP) and MemorialCare Innovation Fund (MCIF). - The funding investors are healthcare-centric: MCIF is a strategic healthcare investment fund wholly-owned by a healthcare system and HEP is a private equity firm that invests exclusively in healthcare services and IT companies.- The funding will accelerate the delivery of personalized care guidance through

Read More

Healthcare Private Equity | PE | M&A| News, Analysis, Insights

AVIA Launches Partner Network with Cerner, Deloitte, AHA, HFMA

Healthcare innovation network AVIA launches AVIA Partner Network for health systems to gain access to proprietary insights and resources.American Hospital Association, Deloitte, Cerner Corporation, and the Healthcare Financial Management Association among leading organizations collaborating to accelerate digital transformation in healthcare.AVIA, the nation’s leading healthcare innovation network, today announced the launch of the AVIA Partner Network, which brings together several prominent

Read More

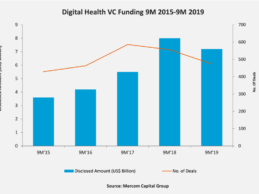

Top Global Digital Health/Health IT VC Funding Categories in Q3 2019

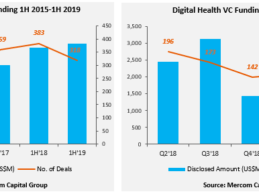

Global venture capital (VC) funding in digital health/health IT, including private equity and corporate venture capital, reached $2B in funding across 156 deals in Q3 2019, according to market research firm Mercom Capital Group. The 9M & Q3 2019 Digital Health (Healthcare IT) Funding and M&A Report reveals global venture capital reached $7.2B over 474 deals in the first nine months of 2019 compared to $8B in 556 deals in 9M 2018. In Q3 2019, Digital Health companies raised $2B in 156

Read More

PE Firm Warburg Pincus Acquires CareLogic Behavioral Health EHR Platform

- Private equity firm Warburg Pincus has acquired CareLogic behavioral health platform to accelerate product development and expand sales and marketing efforts.

- Qualifacts' CareLogic Enterprise Software is a comprehensive Electronic Health Record (EHR) designed for behavioral health, mental health, & human services.

- The partnership will also help the company identify strategic relationships and acquisition opportunities.

Warburg Pincus,

a healthcare technology

private

Read More

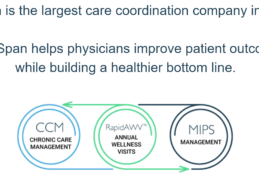

PE Firm Backs Nation’s Largest Care Coordination Company ChartSpan

Blue Heron Capital, a growth private equity (PE) firm based in Richmond, Virginia has announced its investment in a Series A round of funding in ChartSpan, the largest healthcare managed service provider of chronic care management. The firm is part of a five-investor syndicate.Impact of Chronic Conditions on Patient Health OutcomesAn alarming 75% of Americans over the age of 65 live with multiple chronic conditions that require ongoing medical attention and often impact their ability to live

Read More

M&A: PE-Backed Guidehouse Acquires Navigant Consulting for $1.1B

Guidehouse (formerly PwC’s US Public Sector business), a portfolio company of private equity firm Veritas Capital has acquired global management consulting firm Navigant Consulting, Inc. for approximately $1.1 billion. The newly combined entity will bring together each organization’s strong expertise in highly regulated industries across both the commercial and government sectors, with a focus on supporting client needs in the industries of Healthcare, Financial Services, Energy, National

Read More

HIM Provider Ciox Health Lands $30M to Expand Health Data Repository

Ciox Health, a provider of health information management solutions has raised $30 million in equity investment capital led by Merck Global Health Innovation Fund (Merck GHIF) and private equity owner New Mountain Capital. Every record represents a real person. Each data point is a potential game-changer in someone’s life: a connection to be understood and acted upon. Ciox rapidly and securely facilitates access to clinical records on behalf of its healthcare provider customers, enabling

Read More

Global Digital Health VC Funding Breaks $5.1B in First Half of 2019

Global venture capital (VC) funding in digital health/health IT, including private equity and corporate venture capital, reach $5.1 billion in the first half of 2019, according to market research firm Mercom Capital. The 1H and Q2 2019 Digital Health (Healthcare IT) Funding and M&A Report reveals $5.1B in funding across 318 deals compared to $4.9B across 383 deals in 1H 2018. Q2 2019 VC funding held strong at $3.1 billion in 169 deals following the $2 billion raised in 149 deals in Q1 2019.

Read More

Net Health Acquires Post-Acute Care EHR Provider Optima Healthcare Solutions

Net Health, a provider of cloud-based software solutions for specialized outpatient care, today announced it has acquired cloud-based post-acute care EHR provider Optima Healthcare Solutions. Optima post-acute care EHR platform supports contract therapy companies, skilled nursing and assisted living facilities, outpatient therapy clinics, home health therapy providers and hospice organizations.Acquisition Benefits for Net HealthOnce the acquisition closes, the combined company will serve

Read More

PE Firm Acquires Secure Health Information Exchange Company Vyne

Vyne, a provider of secure health information exchange and electronic healthcare communication management has been acquired by The Jordan Company, L.P., a middle-market-focused private equity firm with original capital commitments in excess of $11 billion. This new investment supports Vyne’s commitment to providing market-leading healthcare technology and support to thousands of dental practices, hospitals and major health systems across the United States.Expansion Plans for VyneThe acquisition

Read More