What You Should Know:

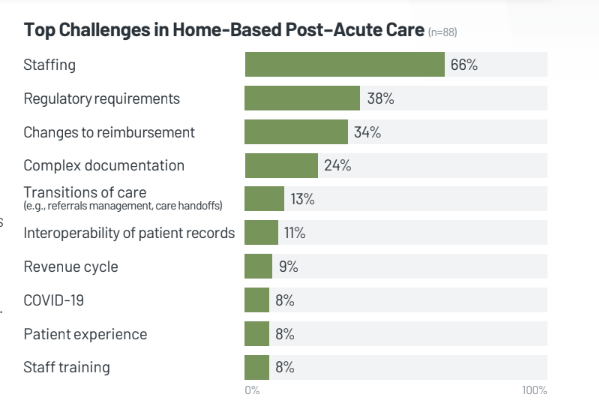

– The homecare market has surged as healthcare organizations have sought to maintain quality patient care throughout the pandemic and fulfill requirements for value-based reimbursement, according to the latest KLAS report. Organizations are looking to expand their homecare offerings; however, the pandemic has exacerbated staffing shortages and decreased bandwidth, making operations—let alone growth—difficult. To help organizations understand how peers are approaching the current environment, KLAS interviewed 88 leaders from home-based care organizations regarding the top challenges they face and the technology vendors they use or have considered investing in to address these challenges.

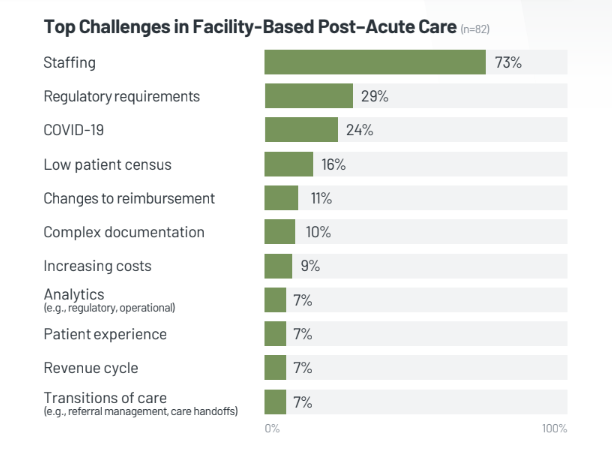

– KLAS also reveals The COVID-19 pandemic brought a wave of challenges to facility-based post-acute care organizations (i.e., SNFs, LTCHs, and IRFs). Staffing has become a particular pain point, with organizations citing burnout, increased competition with staffing firms, and intensive patient care for severe COVID-19 cases as contributing factors. To help organizations understand how peers are approaching the current environment, KLAS interviewed 82 leaders from facility-based post-acute care organizations regarding the top challenges they face and the technology vendors they use or have considered investing in to address these challenges.

Evaluating the Role of Home-Based Post-Acute Care and Facility-Based Post-Acute Care

KLAS has recently released two reports, “Facility-Based Post–Acute Care 2022 and Home-Based Post–Acute Care 2022” which evaluate the top challenges in the aftermath of the pandemic, specifically in terms of home-based post-acute care and facility-based post-acute care. Although both reports convey their findings in a similar manner, the differences between facility-based care and home-based care can be astutely observed.

Key themes and findings that pertain to facility-based post-acute care are listed and explained as follows:

1. Respondents Look to EMRs & Online Recruiting Technology to Address Top Challenges: Staffing is the number-one challenge respondents report facing today, followed by regulatory requirements and the pandemic. However, these challenges often overlap and perpetuate one another. For example, both the pandemic and documentation workflows—which are often made challenging due to new regulations or changes to reimbursements—exacerbate burnout and can prompt staff to leave. To address these challenges, respondents are looking to online recruiting tools, EMRs, and COVID-19 screening tools. Organizations are competing with staffing firms over resources; some respondents must pay triple the standard cost to hire staff. Additionally, many respondents feel that the pandemic has contributed to staff shortages, thus limiting the number of patients an organization can care for. Organizations are investing in scheduling technology to manage staffing shortages and fill shifts more easily. Regulatory requirements are a top challenge on their own, and they also impact other areas of concern, including changes to reimbursements and revenue cycle. Many respondents are frustrated that the requirements introduce redundancy to clinician workflows, make documentation overly complex, and increase the need for reporting. When possible, respondents are most likely to utilize their EMR to address these challenges; several regulatory-compliance vendors (i.e., HEALTHCAREfirst, Team TSI, SimpleLTC) are also mentioned as helping organizations stay ahead of regulatory changes. Regulatory requirements are a top challenge on their own, and they also impact other areas of concern, including changes to reimbursements and revenue cycle. Many respondents are frustrated that the requirements introduce redundancy to clinician workflows, make documentation overly complex, and increase the need for reporting. When possible, respondents are most likely to utilize their EMR to address these challenges; several regulatory-compliance vendors (i.e., HEALTHCAREfirst, Team TSI, SimpleLTC) are also mentioned as helping organizations stay ahead of regulatory changes.

2. MatrixCare, PointClickCare, and Indeed Most Commonly Deployed to Address Top Challenge: Many respondents are looking to address top challenges with the technology they have already deployed at their organization. MatrixCare and PointClickCare are most often mentioned by respondents, who are hoping to alleviate staffing challenges by giving staff easy-to-use tools that will streamline workflows and improve the user experience. Epic and WellSky also have respondents looking to them for streamlined documentation workflows. The two vendors have smaller footprints in the long-term care market; Epic serves primarily large IDN customers, and WellSky is live in mostly IRFs. KLAS performance data for MatrixCare, PointClickCare, Epic, and WellSky indicates they are well positioned to help tackle workflow challenges; each customer base generally reports satisfaction with their respective product’s ease of use and the delivery of new technology. Indeed and Meta (Facebook) are the recruiting tools most mentioned by respondents. Enquire is the most-mentioned vendor that doesn’t offer an EMR or staffing solution; they instead offer various products tailored to CRM, referral management, care transitions, and preauthorization.

3. Respondents Often Consider Investing in New EMR to Improve Documentation Workflows: About one-third of respondents are considering investing in additional technology to address their top challenges. They are most likely to invest in a new EMR; KLAS ’ broader research in this market indicates that about 20% of facility-based post-acute care organizations (up from 13% in 2019) regret purchasing their current EMR solution or don’t consider it to be part of their long-term plans. Respondents looking to simplify complex documentation workflows and increase efficiency most often consider MatrixCare and PointClickCare. Respondents looking to address staffing challenges are focused on scheduling technology from vendors like OnShift and symplr. OnShift is mentioned because their scheduling, HR, and payroll offerings are integrated, thus simplifying back-office processes. symplr is highlighted for their scheduling and secure communications solutions. Additionally, respondents hope to improve the patient experience by investing in apps that patients can use for telemedicine and scheduling; many are planning to roll out solutions from their EMR vendor. In an effort to reduce costs, respondents are considering vendors like vcpi for outsourced IT support and Flock for HR functionality.

Key themes, ideas, and insights from the report pertaining to home-based post-acute care are as follows:

1. Respondents Look to EMRs & Regulatory-Compliance Technology to Address Top Challenges: Many factors contribute to current staffing shortages, including difficult work environments and burnout. Respondents hope to retain staff by enhancing documentation, technology, and training. Some are also looking to leverage online recruiting tools. Second to staffing are concerns about regulatory requirements and changing reimbursement—both of which increase documentation complexity and potentially increase burnout. For redress, respondents are considering EMRs, regulatory-compliance technology, and revenue cycle services.

2. MatrixCare, SHP, Netsmart, and WellSky Most Commonly Deployed to Address Top Challenges: Most respondents are looking to address top challenges by leveraging technology that will streamline internal processes (e.g., clinician workflows, rejections, automated EVV). Respondents typically evaluate their EMRs first for additional optimization and functionality; as a result, EMR vendors MatrixCare, Netsmart, and WellSky are among the most commonly utilized. MatrixCare customers value the product’s ease of use and regular enhancements. Satisfaction with Netsmart’s go-forward solution, myUnity Enterprise, is mixed—many customers are awaiting additional workflow enhancements. WellSky customers say the revenue cycle tools facilitate efficient processes. Homecare Homebase is also frequently considered or deployed to improve complex documentation. The product meets a broad range of needs, especially around keeping customers compliant with revenue cycle regulations. Customers are waiting for the vendor to further enhance workflows. SHP is the most frequently utilized non-EMR vendor in this report sample. They offer a broad suite of solutions, including analytics and satisfaction surveys. Finally, multiple respondents utilize Forcura; respondents say the document management solution interfaces with their EMR and provides communication and documentation tools.

3. Respondents Often Consider Investing in New EMR to Improve Documentation Workflows: Due to resource constraints, only one-fifth of respondents are considering investing in additional technology to address their top challenges. They are most likely to invest in a new EMR; KLAS’ broader research in this market shows that 28% of home-based post–acute care organizations (up from 18% in 2019) regret purchasing their current EMR solution or don’t consider it to be part of their long-term plans. Looking to simplify complex documentation workflows and increase efficiency, organizations mention considering Epic, Homecare Homebase, MatrixCare, and WellSky. To address other common challenges, respondents mention considering a variety of vendors, including Workforce.com and CareXM (staffing), Vivify Health and MatrixCare (patient experience), Health Recovery Solutions and Ushur (telehealth), and Bamboo Health and Salesforce (transitions of care)