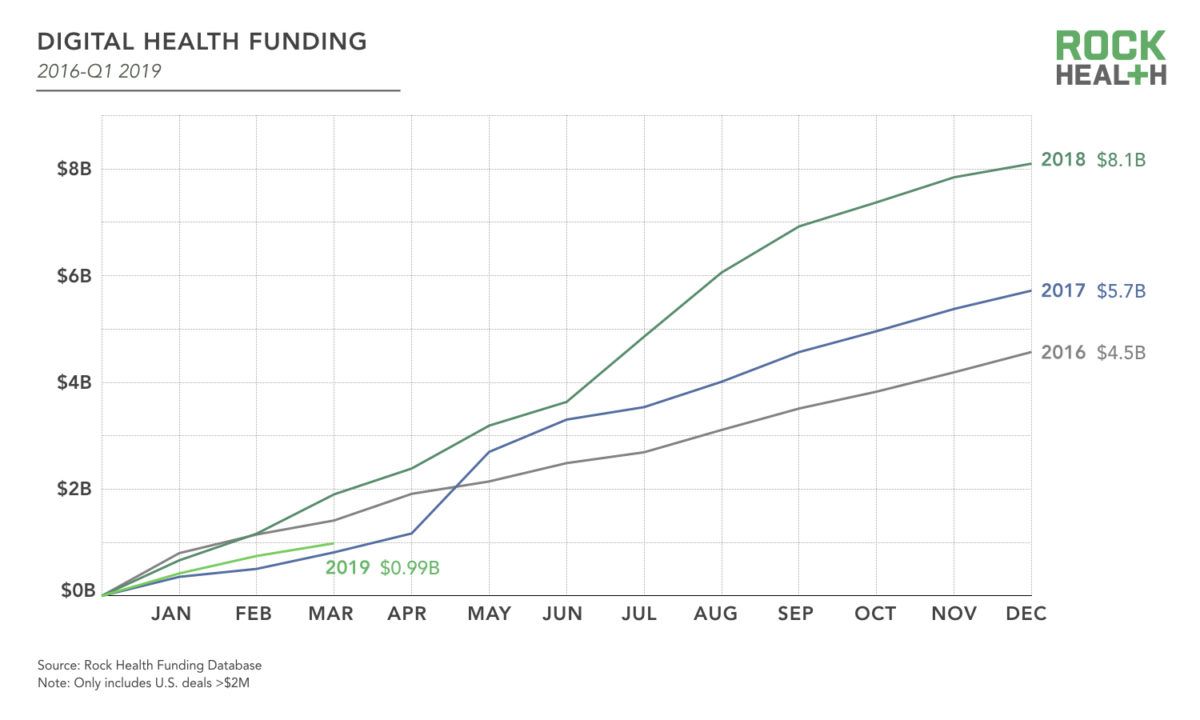

Notwithstanding the quite significant stock market turmoil for publicly traded healthcare companies in recent months, the level of private investment activity continued to be quite strong this past quarter. According to Rock Health, 1Q19 registered just under $1.0 billion of investments made in 61 healthcare technology companies, which while below the trailing two year quarterly average of $1.4 billion, still suggests an annual investment pace running toward $4.0 billion. StartUp Health, which reports global funding data and includes non-software healthcare companies, tabulated $2.8 billion invested in the quarter.

It certainly appears that 2018 may well have been a high-water mark for digital health funding. Over the last five years, between 300 – 375 companies were funded annually in the healthcare technology sector. A more modest investment pace arguably will lead to a greater degree of consolidation, from which stronger companies should emerge. It also suggests that management teams and investors should be even more vigilant about expenses to ensure appropriately long cash runways to hit value-creating milestones.

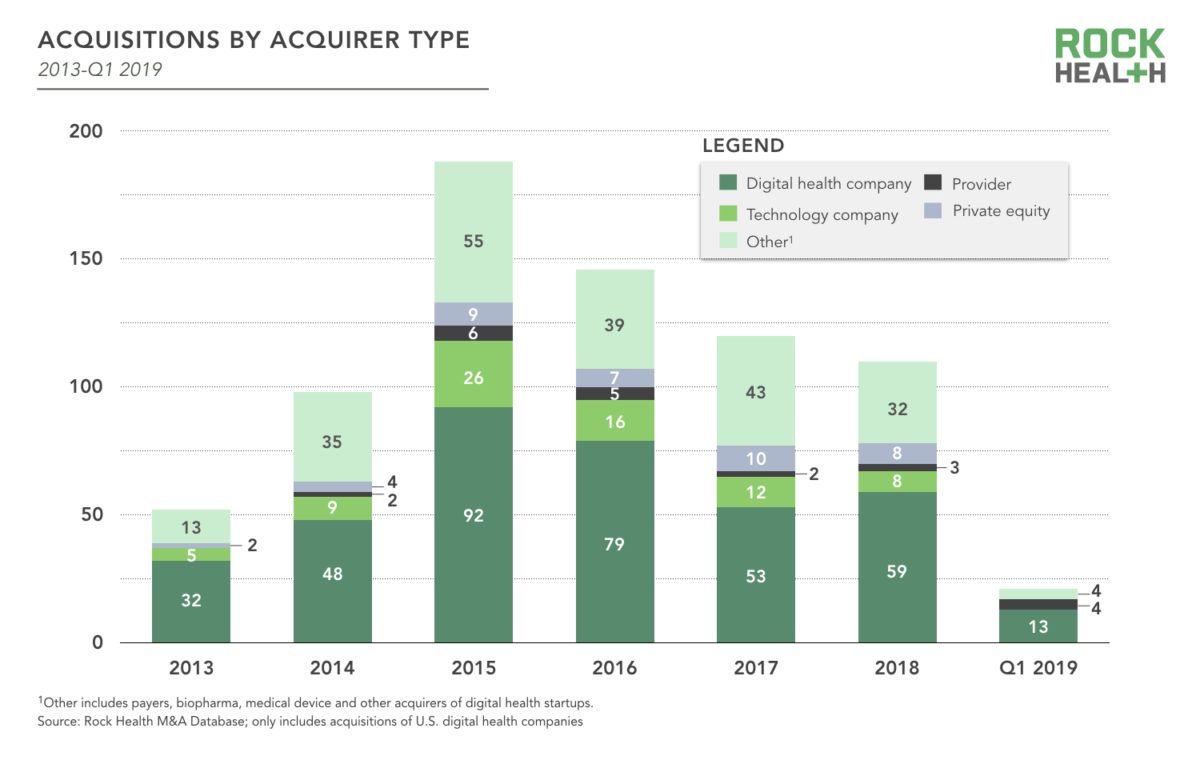

A review of Rock Health’s analysis of M&A activity in the healthcare technology sector is quite illuminating. Given the lack of sector-specific IPOs, the M&A dynamics become even more important to assess. Clearly, the overall level of activity is trending down in terms of the number of transactions while the percent of “in sector” consolidation among healthcare technology companies is consistently just over half of the total merger activity. While mostly conjecture, much of that consolidation is likely uninspiring for the selling shareholders. Much of the other M&A activity likely reflects larger companies back-filling for gaps in their own product roadmaps, particularly in light of the dramatic vertical healthcare mergers (CVS/ Aetna, Cigna/Express Script). A strong case can be made that once the re-architected playing field emerges, the pace of strategic M&A will accelerate as companies seek to fortify positions in a particular market.

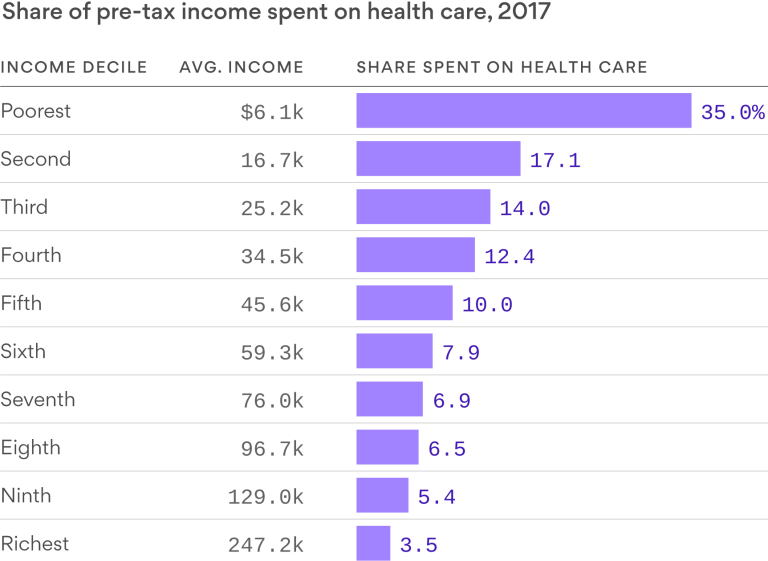

Broadly speaking, there is a high level of venture investor enthusiasm for companies that improve both affordability and access. There has also been a notable increase in investment in care coordination and monitoring start-ups, in part due to the recent establishment of billing codes by Center for Medicare and Medicaid Services (CMS) for those products. In light of staggering income inequities highlighted below in the Axios analysis, it is not surprising that recent investment activity has tended to focus on businesses that are outcomes based and have the ability to take on risk, driving value-based models. The 2018 poverty line for a 4-person household was $25,100. Those families are paying between 14% – 35% of income on healthcare. What are the innovative models that can lessen the burden for those Americans?

The early stage healthcare technology community does not operate in isolation. Interestingly, Bain & Co. calculated that $63.1 billion was invested in healthcare transactions by the private equity industry in 2018, an increase of 50% from 2017 and the highest level since 2006. Over $35 billion of that activity was in 159 provider deals, as broadly speaking, there was a trend to transition away from acute care settings into more specialty, consumer-centric care models. These new entities arguably will look to early-stage innovative solutions to make their offerings more effective and outcomes oriented. It was not surprising to see MobiHealthNews report on App Annie data that showed global medical apps downloads was more than 400 million in 2018, which was 15% ahead of the 2017 pace.

Corporate venture capitalists have participated in approximately one-third of all healthcare technology financings consistently over the last five years (as compared to all other sectors which has corporate participation in the ~15% range). In particular, the healthcare systems have been quite active venture investors, in large measure as a strategy to incorporate novel solutions into clinical workflows and to generate non-traditional revenue streams, all encouraged by the transition to value-based care models.

According to an analysis prepared by Axios, the average healthcare system generated nearly twice as much operating income from investment activities than from clinical activities in 2017. Interestingly, the twelve largest not-for-profit health systems reported cumulative investment losses in 2018 of $3.7 billion due to 4Q18 public equity turmoil. In 2017, aggregate investment gains were $11.4 billion for those same dozen providers.

In sharp contrast, it was recently reported that IBM Watson – yet again – will be retooled and that Watson for Drug Discovery will no longer be sold. This follows the June 2018 announcement that Watson Health was scaling back its offerings targeting the provider segment. Many large legacy vendors struggle with how best to incorporate novel AI and ML solutions into their broader healthcare suite of solutions, opening the door for innovative start-ups.

Given the enormity of the market opportunities, as well as the promise of new healthcare technology solutions coming to market, the recent public equity performance in April 2019 was especially incongruous. Political uncertainties that will directly inform healthcare policies post-2020 (role of government in healthcare, pricing transparency, etc) have pushed the S&P 500 Healthcare Index down 4.4% in April month-to-date, generating losses of $150 billion in market capitalization. Notwithstanding that healthcare was the best performing sector in 2018 of all industry sectors, year-to-date 2019 healthcare stocks are lagging at a near-historic rate (only up 4.2% versus S&P 500 which has increased nearly 16%). Ironically, healthcare is expected to exhibit the strongest earnings growth of all sectors in 1Q19 per FactSet with 3.9% quarterly growth (although the pharmaceuticals sector is expected to decrease by 4.0%). Currently, the healthcare sector is trading at 15.3x P/E ratio versus 16.9x for the broader stock market.

Sounds like a “buy” to me.

About Michael A. Greely

Michael A. Greely is the CoFounder and General Partner at Flare Capital Partners, a venture capital firm focused on investing in early stage and emerging healthcare technology companies. Previously, Michael was the founding General Partner of Flybridge Capital Partners where he led the firm’s healthcare investments. Current and prior board seats include Aspen Health, BlueTarp Financial, Circulation, Explorys, Functional Neuromodulation, HealthVerity, higi, Iora Health, MicroCHIPS, Nuvesse, PolyRemedy, Predictive Biosciences, Predilytics, T2 Biosystems, TARIS Biomedical, VidSys and Welltok (observer).