What You Should Know:

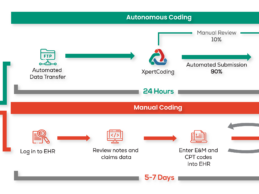

- Today, XpertDox, LLC., a Birmingham, AL-based revenue cycle company specializing in autonomous medical coding powered by artificial intelligence raises $1.5M from TN3, LLC, an Arizona based Private Equity Capital firm.

- XpertDox's XpertCoding solution harnesses the power of artificial intelligence in order to autonomously code medical claims faster, more accurately, and cheaper than traditional manual processes. XpertDox is utilizing the funding to

Read More

Healthcare Private Equity | PE | M&A| News, Analysis, Insights

CVS Health to Acquire Signify Health for $8B

What You Should Know:

- CVS Health announced it will acquire Signify Health for $30.50 per share in cash, representing a total transaction value of approximately $8B.

- Signify Health's clinicians and providers can have an even greater impact by engaging with CVS Health's unique collection of assets and connecting patients to care how and when they need it.

Advancing CVS Health’s Value-Based Care Long-Term Strategy

Signify Health is a provider of Health Risk Assessments, value-based

Read More

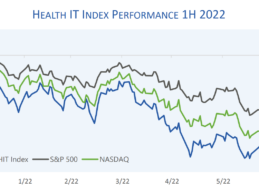

Healthcare & Life Science M&A Activity Plummets 1H’22

What You Should Know:

- The index of Healthcare & Life Science equities tracked by Stout was down 16.8% in Q2 2022, which was in line with the S&P 500 decline of 16.4%.

- Healthcare & Life Science M&A activity plummeted to 338 deals in Q2 2022 versus 535 in Q2 2021 and a record 565 deals in Q4 2021. The report reveals credit markets likely to tighten, but a healthy level of M&A is expected to continue in the growing and defensive healthcare sector.

Key Trends and

Read More

Analysis: 2022 Semi-Annual Health IT Market Review

Executive Summary

Act III of COVID: Navigating the Crosscurrents of Post-Inflation

2022 ushered in Act III of the market’s latest transitionary period: The Post-Inflation Era. Since 2008, the US economy functioned with remarkably low inflation and interest rates. As the cost of capital went lower and lower during the decade, valuations steadily rose. Between 2010 and 2020, the NASDAQ experienced a 17.1% annual growth rate, with no small share of the growth a result of expanding valuation

Read More

M&A: Bain Capital Acquires Majority Stake in LeanTaaS

What You Should Know:

- Private equity firm Bain Capital has acquired a majority stake in the company in LeanTaaS, a leading provider of cloud software solutions for optimizing hospital operations and capacity management that will enable LeanTaaS to accelerate its rapid growth trajectory.

- LeanTaaS’ cloud-based iQueue solutions help hospitals transform their approach to care delivery and improve capital and scarce resource decision-making by optimizing the utilization of

Read More

PE Firm Acquires Intelligent Medical Objects (IMO) for $1.5B+

What You Should Know:

- Thomas H. Lee Partners, a premier private equity firm investing in growth companies, announced today that it has entered into an agreement to acquire a majority interest in Intelligent Medical Objects, a healthcare data enablement company and market leader in clinical terminology solutions in a $1.5B + deal.

- Founded in 1994, IMO manages more than 5 million clinical terms and maps to all major coding systems. Its suite of software products, which is used by over

Read More

Day 3 HIMSS Roundup: Glooko Acquires DIABNEXT, GE Healthcare/AliveCor Integration

Venture Capital, Private Equity, Mergers & Acquisitions (M&A) Activity

Glooko Acquires DIABNEXT® to Expand Diabetes Offerings in France

Glooko, a leading provider of remote patient monitoring and data management solutions for diabetes and related chronic conditions, today announced the acquisition of DIABNEXT, a Paris-based company whose digital health platform helps people with diabetes better manage their conditions and connects to their healthcare providers, so they can

Read More

How Support Automation Enhances Clinical Trial Management

The life of a clinical study relies on data from documentation, meetings, emails and calls; all of which can be overwhelming for patients, clinical trial teams and associates. Although mundane, documenting, executing and collecting data is crucial to move a trial from phase to phase.

Clinical trial teams face a multitude of competing priorities, from evaluating hundreds of potential patients to maintaining compliance and recording patient progress. No aspect or step can be neglected for a

Read More

GTCR Acquires Majority Stake in Experity to Drive On-Demand Care

What You Should Know:

- Experity, the national leader in on-demand care solutions, today announced a strategic growth investment from GTCR, a private equity firm with significant experience in healthcare technology and services. Existing investor Warburg Pincus will retain a minority interest in the company

- The strategic growth investment from GTCR, along with the combined capability of two world-class investors (including Warburg Pincus) will provide industry-leading innovation and

Read More

PE Firm WCAS Launches $300M Value-Based Care Portfolio Company, Valtruis

What You Should Know:

Welsh, Carson, Anderson & Stowe (“WCAS”), a leading private equity firm focused exclusively on the healthcare and technology industries, announced that it is launching Valtruis, a unique portfolio company that will invest in and partner with value-based care driven healthcare companies. WCAS is committing an initial $300M to this platform.

Founded on a commitment to accelerate meaningful change, Valtruis brings the functional expertise, access to capital and an

Read More