What You Should Know:

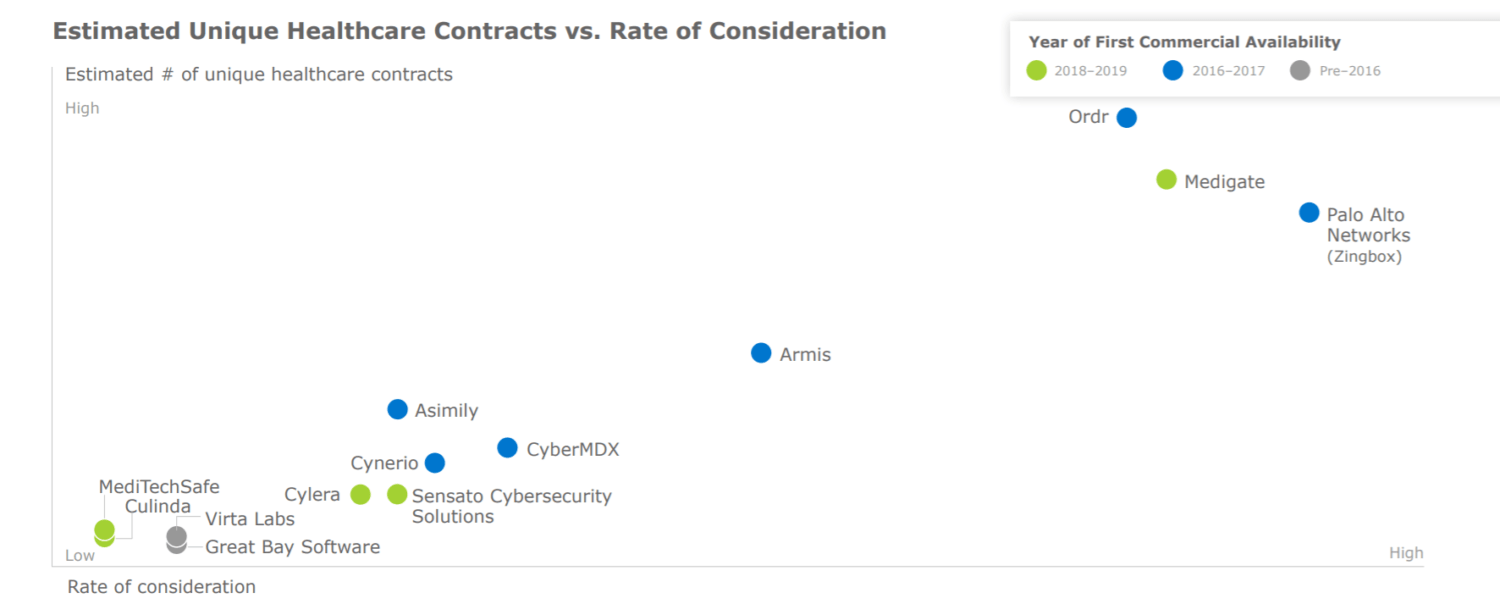

– As the buying wave of healthcare IoT solutions continues, strong technology offerings and numerous new wins in the last year have established Medigate and Ordr as leaders in the growing market.

– KLAS finds that the adoption of security solutions for the healthcare internet of things (IoT) continues to grow as healthcare organizations look for ways to understand and manage the risk associated with connected devices.

The adoption of security solutions for the healthcare internet of things (IoT) continues to grow as healthcare organizations look for ways to understand and manage the risk associated with connected devices. In most deployments, the focus has shifted from securing mainly medical devices to covering both medical devices and the broader IoT devices found in healthcare settings.

KLAS Data Insights Report

As the market matures, organizations are also beginning to look beyond core capabilities—where most solutions are comparable—to factors like cost, ROI, expertise, and vendor culture when making buying decisions. With many strong options in the market, the bar for vendors is high. In the latest KLAS Data Insights report, KLAS spoke with 51 healthcare organizations to understand which vendors are being selected and why and to glean early insights into customer satisfaction. Data insights for this report comes from KLAS Decision Insights data and KLAS performance data.

Medigate, Ordr Emerge as Leaders in Growing Healthcare IoT Market

As the buying wave of healthcare IoT solutions continues, strong technology offerings and numerous new wins in the last year have established Medigate and Ordr as leaders in the growing market. KLAS finds that Medigate’s is picking up steam and showing rapid growth since last year. Medigate’s technology delivers detailed information to customers through device-fingerprinting capabilities.

Healthcare organizations that have recently selected Medgate point to the vendor’s expanded IoT capabilities as an added plus in comparison to being traditionally selected solely for medical devices. Healthcare organizations that did not select Medigate cited concerns over price or challenges during the sales cycle.

Customers who recently chose Ordr, whose market share has consistently grown year over year, were drawn to the breadth and number of devices Ordr can detect and the highly granular visibility the solution provides. Feedback on the user experience is mixed, though customers say that once users are properly trained, the tool drives deep insights. Ordr’s culture of flexibility and willingness to partner stand out as reasons they are selected. Prospective customers that did not select Order, cited other vendors as having a deeper knowledge of medical devices.

Other key findings of the KLAS report include:

Palo Alto Acquisition of Zingbox Creates Uncertainty

– Zingbox—acquired by Palo Alto Networks in fall 2019— was the early market leader as they continue to be considered in most decisions, but a majority of prospective clients select other vendors, in large part due to uncertainty about Zingbox’s future under Palo Alto Networks.

Concerns about Armis’ Technology Abilities Driven by Sales Team

– KLAS validated very few organizations that selected Armis. Cross-industry vendor Armis is increasingly considered in healthcare IoT security decisions; today, their traction in the healthcare industry is average.

Asimily and Up-and-Coming Sensato Leverage Healthcare Expertise for Early Traction

– Asimily has continued to grow and acquire customers in the last year as current customers see Asimily’s networking and healthcare expertise as differentiators. Healthcare organizations that select Asimily appreciate the vendor’s honesty about what they will and won’t do and how development requests fit into the product road map.

CyberMDX and Cynerio See Overall Slow Market Traction

– KLAS-validated considerations and new wins of healthcare-focused vendors CyberMDX and Cynerio have been much lower than that of most other commonly considered vendors.

For more information about the latest KLAS Data Insights report, visit https://klasresearch.com/report/healthcare-iot-security-2020/1619