What You Should Know:

The digital health landscape in 2024 was marked by a surge in early-stage investments alongside significant moves by established healthcare giants, according to Rock Health’s annual end of the year funding report.

– The Rock Health report states the “David and Goliath” phenomenon has created a complex ecosystem where both small startups and large players are vying for a share of the innovation pie.

A Year of Contrasts

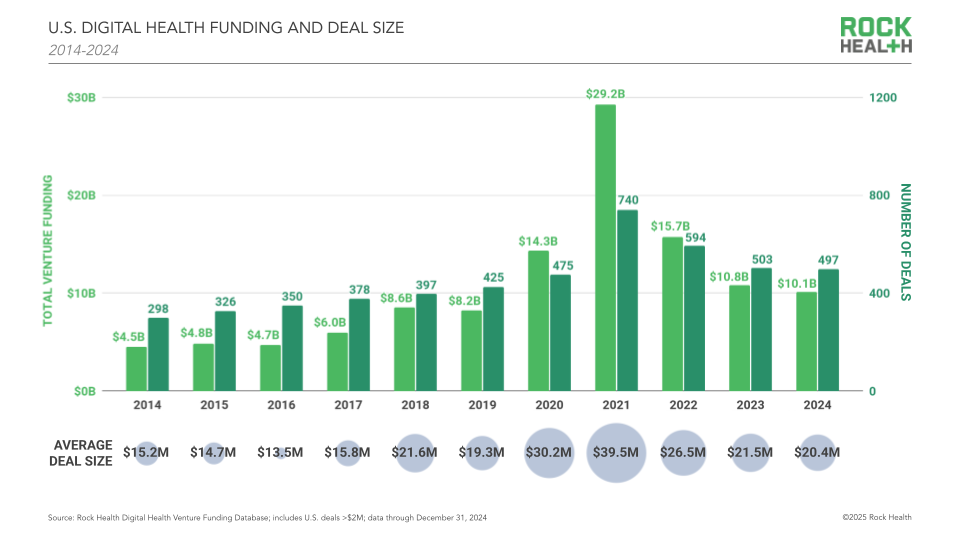

While venture funding in U.S. digital health reached $10.1B across 497 deals, this figure represents a slight decline from 2023, and when adjusted for inflation, is nearly identical to 2019 funding levels. This apparent slowdown can be attributed to two key factors:

- Focus on Early-Stage Investments: Investors are increasingly betting on younger companies, with a significant portion of funding directed towards Seed, Series A, and Series B rounds.

- Smaller Late-Stage Deals: Later-stage companies are raising smaller rounds compared to previous years, with a decline in mega-deals exceeding $100M.

This trend suggests a shift in investor priorities, with a focus on nurturing early-stage innovation while exercising caution in later-stage investments.

The Rise of Mega Funds

Another defining trend in 2024 was the growing influence of “mega funds” like Andreessen Horowitz (a16z) and General Catalyst (GC). These heavyweight investors, with vast resources and brand recognition, are playing a significant role in shaping the digital health landscape.

Their strategies include:

- Promoting AI: a16z is leveraging its platform to champion AI and support AI-driven startups.

- Facilitating Partnerships: GC is fostering collaborations between its portfolio companies and key healthcare players.

- Driving Acquisitions: Mega funds are enabling their portfolio companies to acquire smaller players, consolidating influence within specific sectors.

Navigating the David and Goliath Dynamic

This dynamic presents both challenges and opportunities for startups. While mega funds can provide significant capital and strategic support, they can also influence company trajectories and potentially alter deal terms. Startups must carefully consider their goals and priorities when seeking investment, choosing partners that align with their vision and values.

AI and the Rise of Foundation Models

AI continued to dominate the healthcare innovation landscape in 2024, with significant funding directed towards AI-enabled digital health startups. However, the AI space is also experiencing concentration, particularly in the development of foundation models.

Big Tech players and open-source initiatives are leading the development of these foundational AI models, which power a wide range of healthcare applications. This creates a challenge for smaller startups, who must carefully differentiate themselves and find niche markets to compete effectively.

Concentration in Value Propositions and Clinical Indications

Funding in 2024 was concentrated on specific value propositions and clinical indications, including nonclinical workflow, mental health, and obesity care. This trend is driven by factors such as:

- Industry Buzz: Excitement around areas like GLP-1s and mental health has attracted significant investment.

- Shared Dynamics: Underlying trends like the rise of AI and the increasing prevalence of chronic conditions have fueled investment across related categories.

- Goliath Expansion: Large digital health companies are expanding their offerings through acquisitions, addressing multiple value propositions and therapeutic areas.

Opportunities for All

Despite the challenges of navigating a David and Goliath landscape, there are opportunities for both large and small players in the digital health ecosystem. Startups can leverage their agility and focus on niche solutions, while established companies can provide resources and market access to accelerate innovation.

The key to success lies in understanding the evolving dynamics of the market, recognizing the value of collaboration, and maintaining a clear vision for how to deliver impactful solutions that improve healthcare.Click here to learn more information about Rock Health’s report.