What You Should Know:

- Cerner, one of the major software vendors in healthcare IT, has gone through significant changes over the last year and a half. In October 2021, they announced a new CEO and introduced RevElate as their go-forward patient accounting platform. Two months later, Oracle announced their intent to acquire Cerner. Customers soon reached out to KLAS, wanting to know about their peers’ experiences with these changes.

- To gather this information, KLAS has been meeting regularly with leaders from over 20 healthcare organizations. This report shares their transition experience and how it has impacted their confidence in Cerner—now Oracle Health—as their go-forward partner. Customer insights come from three rounds of interviews:

• Round 1—March 2022: Customers’ initial thoughts on company changes

• Round 2—July 2022: Customers’ perceptions after Oracle Health finalized the acquisition of Cerner and announced the company vision

• Round 3—November 2022: Customers’ impressions after Oracle Cerner Health Conference (OCHC).

Key Trends and Insights Regarding Customer Perceptions of Oracle Health

This study is composed of findings gathered from three rounds of interviews with Oracle Health (Cerner) customers; interviews occurred in March 2022, July 2022, and November 2022. This report—which primarily focuses on insights from the November 2022 interviews—shares customer perceptions of Oracle Health and respondents’ experience ever since Cerner announced big company changes in 2021. To gather these perspectives, KLAS used a supplemental evaluation to interview leaders from 24–26 customer organizations (although KLAS made every effort to interview the same organizations across all three rounds of interviews, the number of respondents sometimes varied).

Key insights are as follows:

Growing Number of Respondents Question Oracle Health as a Long-Term Partner Due to Lack of Tangible Results & Road Map

In March 2022, respondents were generally more optimistic about Oracle Health being a long-term partner. That optimism has dropped over the course of the year, and in November, about one-fourth of respondents reported they no longer see the vendor as a viable long-term partner. Large organizations (1,000+ beds) most commonly switched opinions; many who were previously on the fence now report that Oracle Health is no longer part of their long-term plans, saying there has been very little meaningful communication about RevElate (more details below) and that they can’t keep waiting for the vendor to deliver.

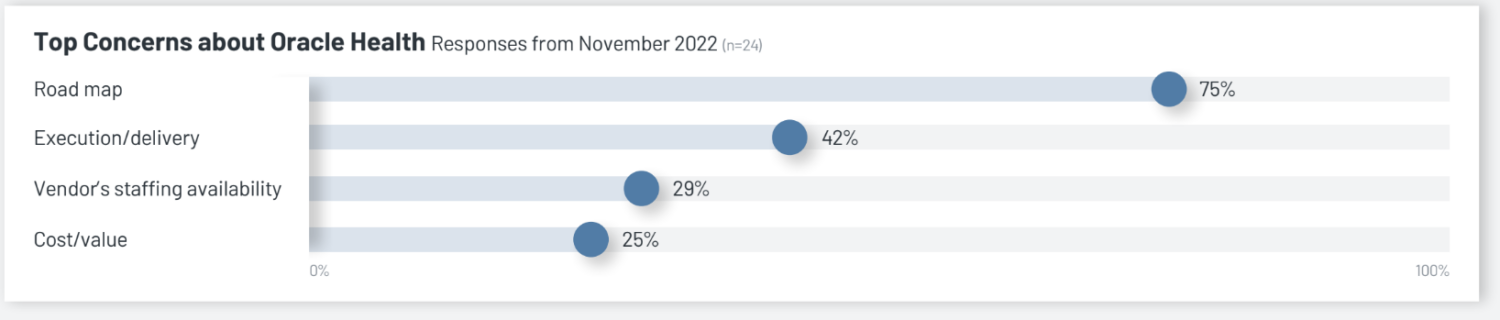

Regardless of size, respondents attribute their decreased confidence to several concerns, such as the unspecific road map, undelivered improvements, and possible price increases under Oracle Health. Additionally, respondents wonder how Oracle Health will have sufficient resources to successfully implement RevElate across the customer base since the vendor is seen as lacking the required expertise and resources in this area (the result of extensive layoffs). Customers would like Oracle Health to deliver on past promises (e.g., around revenue cycle and the physician experience), saying this would increase their confidence in the vendor’s ability to deliver on future promises. Among those who report Oracle Health is part of their long-term plans, few are without reservations. Several will continue as customers because of existing contracts or because the cost of switching vendors is too high. Nearly all say Oracle Health needs to improve its delivery and share a detailed roadmap for future development.

Most Customers Lack Confidence in Oracle Health’s Ability to Execute on Their Vision for the Future

Oracle Health has shared a high-level vision for the future that aligns with organizations’ needs. However, most respondents express concerns about the vendor’s ability to deliver. A top concern is the lack of details in Oracle Health’s plans, which respondents say the vendor has poorly conveyed; as a result, customers are unclear about what will be developed and when those things will be delivered. Even customers who are confident in the vision (those who gave 8 and 9 ratings on a 1–9 scale) point to the vendor’s lack of a clear plan as an opportunity for improvement.

Still, these respondents are more optimistic about Oracle Health’s ability to execute than Cerner’s. Those who are unconfident worry about the ongoing leadership changes and the executives’ ability to make improvements, especially since vendor representatives can’t always describe to customers what direction the company is headed in. Further, customers are concerned that Oracle Health’s focus on their vision will detract them from addressing lingering, unresolved issues and fulfilling promises regarding enhanced functionality.

The survey also contained enlightening insights pertaining to customer perceptions regarding RevElate, which are as follows:

Respondents Express Concerns about RevElate’s Delivery

Over the years, Cerner customers—regardless of which revenue cycle product they use—have had difficulties with their product. The different product iterations have generally not met their expectations, and after more than 20 years of customers feeling Cerner hasn’t consistently delivered a successful product, many are slow to believe things will be different with RevElate. Ever since the platform was introduced in October 2021, most respondents (across all three rounds of interviews) have seen only screenshots of the software and have never viewed the system in a live environment, and some go so far as to call the product vaporware. For respondents to increase their confidence in Oracle Health delivering RevElate, they want to see the system in a live environment and speak directly with beta users about their user experience.

Additionally, in November 2022, 10 of the 24 respondents mention one or both of the following: (1) Oracle, as the acquiring company, doesn’t have enough expertise, and (2) the experienced Cerner resources who could help ensure product success are no longer with the company. Of the three November 2022 respondents who are confident or very confident Oracle Health will successfully deliver RevElate, one notes the product is already live at a couple of sites, and another appreciates the direct communication between their organization and Oracle Health (though the customer still notes Cerner’s history of not delivering). The third respondent is confident but admits the solution’s promised capabilities that haven’t yet materialized will soon be surpassed by other options in the market. Respondents who feel neutral about RevElate don’t know enough details to determine their outlook. Those who are unconfident or very unconfident cite the lack of tangible results as the driving factor.

Despite Gaining Better Understanding of RevElate, Customers Are Dissatisfied with Communication, Have Reservations and Unanswered Questions

Most November 2022 respondents feel they have a better understanding of RevElate than they did 12 months ago when the product was first introduced. However, 84% are dissatisfied with Oracle Health’s communication around RevElate. Much of the RevElate communication has consisted of high-level marketing materials that respondents don’t find helpful, and those who attended the recent OCHC mention that the speakers didn’t focus much on revenue cycle topics or products. Only 1 of the 17 respondents who attended OCHC says the event boosted their confidence in RevElate. One customer believes Oracle Health has become distracted since the acquisition, saying the vendor must get more settled before being able to focus on RevElate.

Respondents still have many unanswered questions, like when they will be able to learn about beta testers’ experience and how RevElate will impact their organization and revenue cycle processes. Several respondents state that their increased understanding is a result of talking with their peers, not from efforts made by the vendor. Three say their greater understanding is thanks to increased executive involvement, including face-to-face meetings that outline product specifications and timelines. Of the four respondents whose understanding of RevElate has greatly improved, only one says they are confident in Oracle Health’s ability to successfully deliver the product; they also note that Oracle Health’s time frames are unrealistic and that the vendor’s staffing problems must be addressed before RevElate can be delivered in a way that meets customer expectations.