It is no secret that technology adoption in healthcare often lags adoption in other sectors. Often, the slow pace of adoption makes sense. While technology can drastically improve both cost and quality in healthcare when implemented correctly, it can also cause physician burnout, increased administrative workload, and worsen patient outcomes if a new technology fails to live up to the hype.

Historically, the slow pace of IT adoption in healthcare was nowhere more apparent than in the adoption of telemedicine. While nearly every other industry adopted widespread use of conference calls, and more recently video chats, in order to collaborate remotely, healthcare providers and patients were both hesitant to adopt these tools to deliver healthcare.

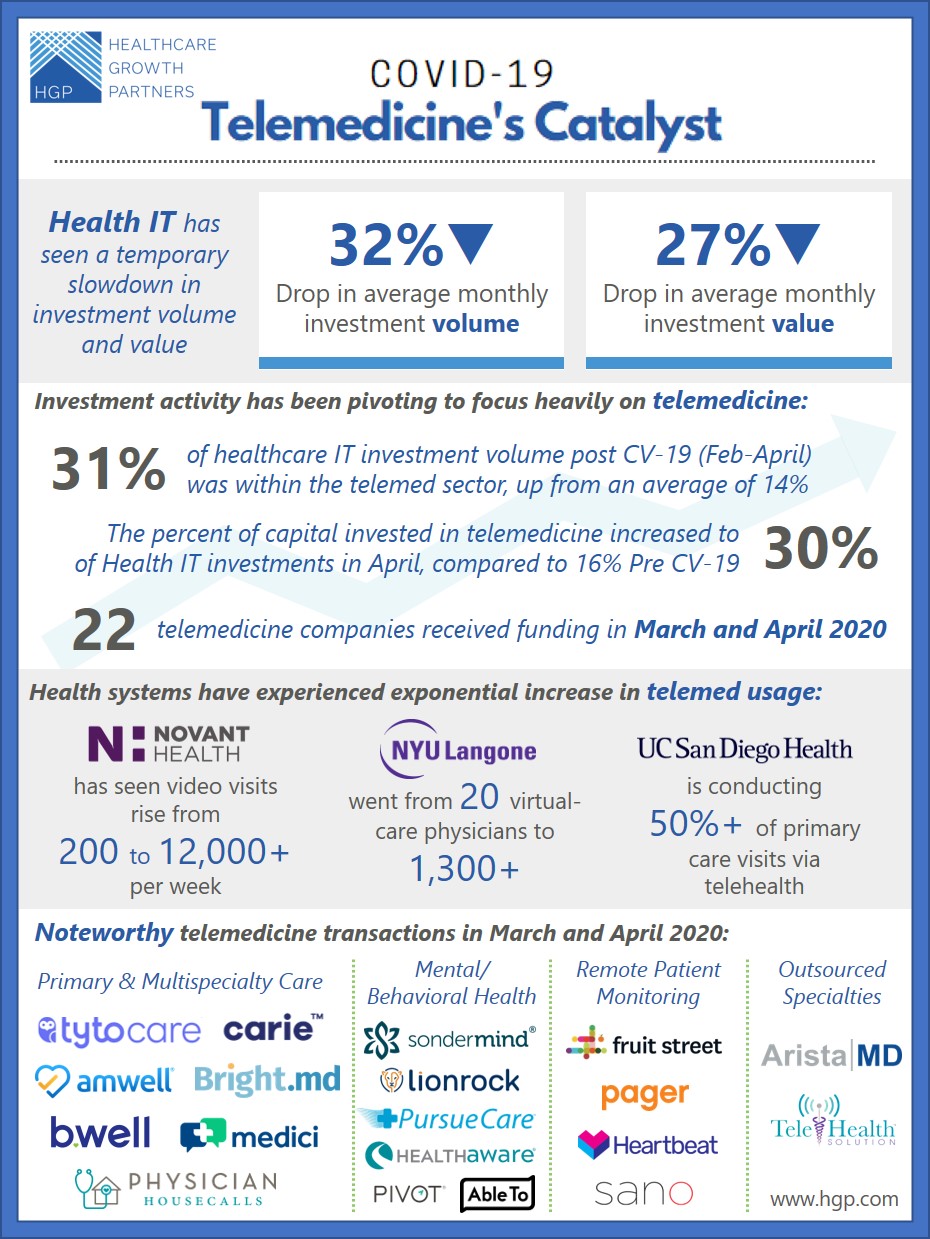

Furthermore, the slow pace of regulatory change around patient privacy and reimbursement provided significant barriers to adoption. COVID-19 has changed all these dynamics in a matter of weeks. Telemedicine has seen a sudden spike in adoption, with many health systems reporting that over half of primary care visits are now being performed via Telemedicine.

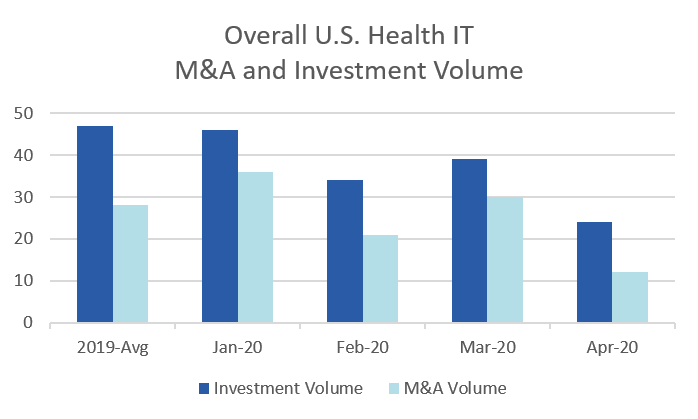

With this seismic shift in telemedicine, we will explore whether these changes have made any impact on the volume or value of investments into telemedicine technologies. In order to understand investment into telemedicine, we’ll first take a look at broader Health IT M&A and investment trends in the HGP Health IT database to understand how COVID-19 has impacted the market.

As can be seen in the chart above, April transaction activity is down significantly compared to both January and the 2019 average. February and March saw some resilience to the downward trend as committed deals went through, but April is a testament to how sharply deal flow has dropped in today’s market. With this context, we can now look at telemedicine and how quickly investors have responded to the shift in demand for telemedicine products.

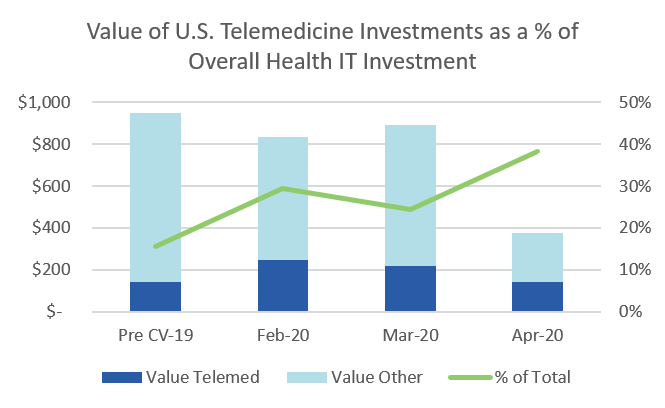

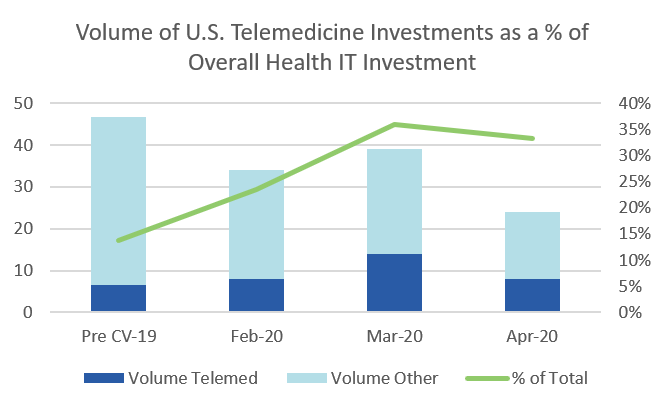

While both the volume and value of investments have declined on the whole, telemedicine has been extremely resistant to these trends. Prior to COVID-19, Telemedicine had represented less than 20% of deals on average. Since February, the number of telemedicine investments has increased to over 30% of investment activity in Health IT. Similarly, while the total value of invested capital has declined to less than $400mm in April, telemedicine investments represented nearly 40% of that capital. In terms of absolute volume and value, telemedicine activity has stayed extremely resilient despite the dire economic downturn we have seen since February.

As telemedicine adoption continues to grow, HGP expects to continue to see strong investment. The thesis around telemedicine has never been stronger, and while COVID-19 has been extremely disruptive across the economy, telemedicine is one of the rare sectors that will see COVID-19 as a net positive influence as we adapt as a society to the situation at hand.

Public Company Performance

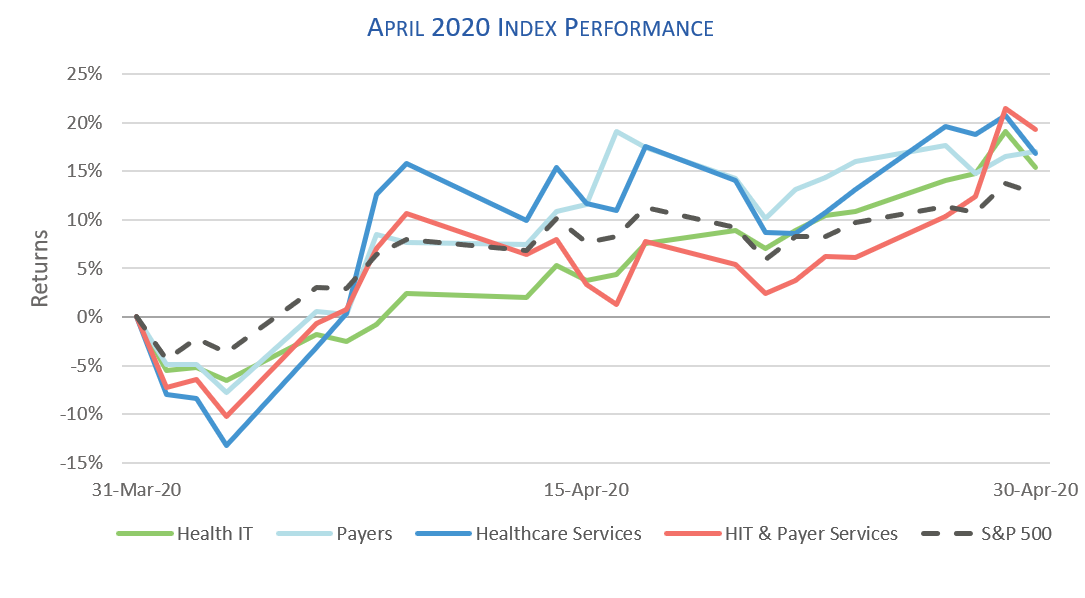

HGP tracks stock indices for publicly traded health IT companies within four different sectors – Health IT, Payers, Healthcare Services, and Health IT & Payer Services. The chart below summarizes the performance of these sectors compared to the S&P 500 for the month of April:

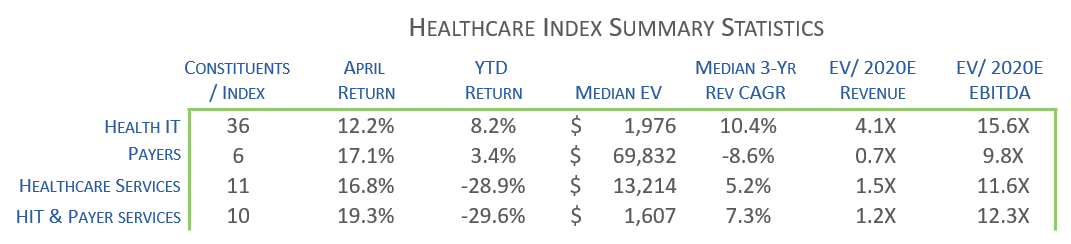

The following table includes summary statistics on the four sectors tracked by HGP for April 2020:

About Healthcare Growth Partners (HGP)

Healthcare Growth Partners (HGP) is a Houston, TX-based Investment Banking & Strategic Advisory firm exclusively focused on the transformational Health IT market. The firm provides Sell-Side Advisory, Buy-Side Advisory, Capital Advisory, and Pre-Transaction Growth Strategy services, functioning as the exclusive investment banking advisor to over 100 health IT transactions representing over $2 billion in value since 2007.