The North American Population Health Management (PHM) reached the $4 billion milestone for the first time in 2018, despite growth slowing for the second consecutive year. With the US provider market consolidating and vertical integration increasing, vendors are having to adapt their offerings to keep up with changing needs. Here is our take on the five trends that will impact market growth over the coming years:

1 – A Market Still Maturing

As the market has evolved, providers are taking a more measured approach into PHM, often using multiple solutions to fit specific needs or use cases. This has driven the market towards a best-of-breed approach with vendors offering integration with existing workflows used in the provider’s EHR or PHM platform. This has also driven a handful of larger PHM vendors to make a platform-play that allows customers to easily integrate third-party applications onto the platform.

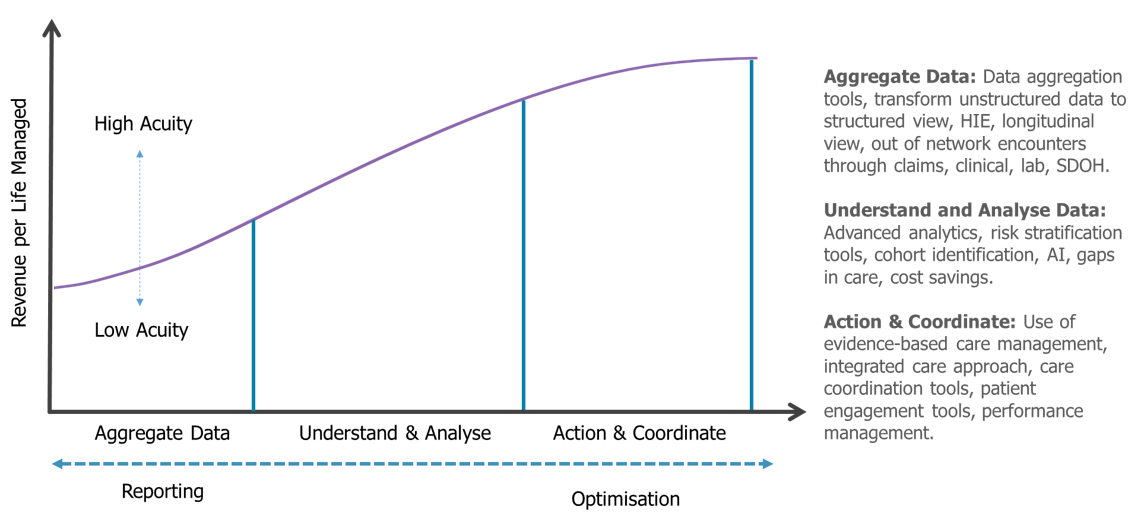

The average revenue per life managed (PMPM) for vendors continued to decrease in 2018, as lower acuity populations are increasingly managed via PHM platforms. But the range being quoted for PMPM is growing. Large health systems taking on multiple types of risk are driving the adoption of care management and patient engagement solutions to manage their highest acuity populations. The shift towards SaaS delivery is now becoming the norm for new deals in the market, with vendors easing off on implementation costs to increase adoption rates.

Market Maturity Model

2 – Clarity on the Impact of ACO Pathways to Success

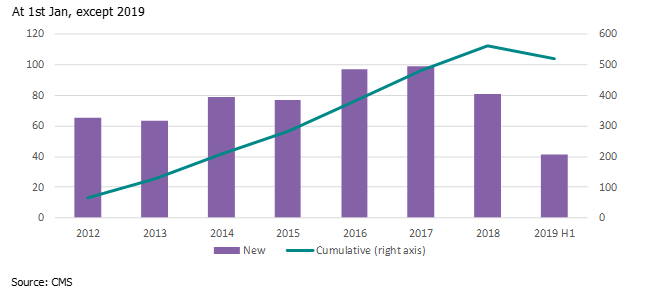

At the start of 2018, there were 561 Medicare ACOs in place (including Share Savings, Advanced Payment and Investment Model only). Due to the CMS Pathways to Success changes moving ACOs into two-sided risk, this number had fallen to 518 by July 2019, with a fall in new ACOs joining the initiative YoY. This was not unexpected, with the changes putting off ACOs that had been unsuccessful in the one-sided risk models from continuing in the initiative.

Despite a slowdown in new ACOs signing up, an estimated 48% of the remaining ACOs were taking on some downside risk by July 2019 (up from 18% from the same time last year). This will open up opportunities for PHM vendors as these organizations take on more complex PHM solutions to better manage high acuity populations and meet quality scores.

Medicare ACO Rollout (Share Savings, Advanced Payment, Investment Model)

3 – New Primary Care Models

New CMS Primary Care First Models will start to be rolled out in January 2020. These will focus on practices ready to assume financial risk in exchange for reduced administrative burdens and performance-based payments. Primary care practices previously had to look for other ways to get reimbursed in a VBC model, either through setting quality targets with payers or being absorbed into larger ACO networks.

It will offer clinicians enrolled in Medicare the ability to take on the risk of beneficiaries that lack a primary care practitioner and/or effective care coordination. The rollout will initially comprise 26 pre-defined regions (encompassing 22 states, Kansas, Northern Kentucky, Philadelphia, two regions in New York). Practices that implement the model are forecast to boost the PHM market from 2020, driving demand for care management, care coordination and patient engagement tools. The impact on the data aggregation, risk stratification, and reporting market will be less.

CMS Primary Care First Model – January 2020 Rollout (blue only)

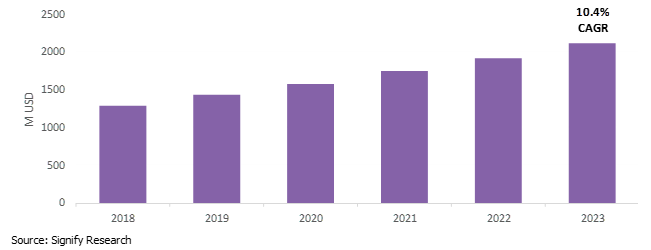

4 – Payers Maintaining Risk

The lines between payers and providers are blurring in the US. Providers are taking on value-based risk, creating their own Medicare Advantage health plans and are direct-contracting with employers. Meanwhile, payers are increasingly acquiring providers and using PHM tools to analyze potential cost savings across healthcare networks.

Combined, these factors have resulted in an uplift in payers utilizing PHM functionality to identify potential cost-savings from partner health systems and via quality-based contracting. But outside of ACOs, there are still few incentives for providers to take on risk-bearing contracts. This slowdown in PHM demand from the provider market has resulted in vendors starting to repackage solutions to service and meet demands in the payer vertical.

North American PHM Market – Payer Vertical (2018-2023)

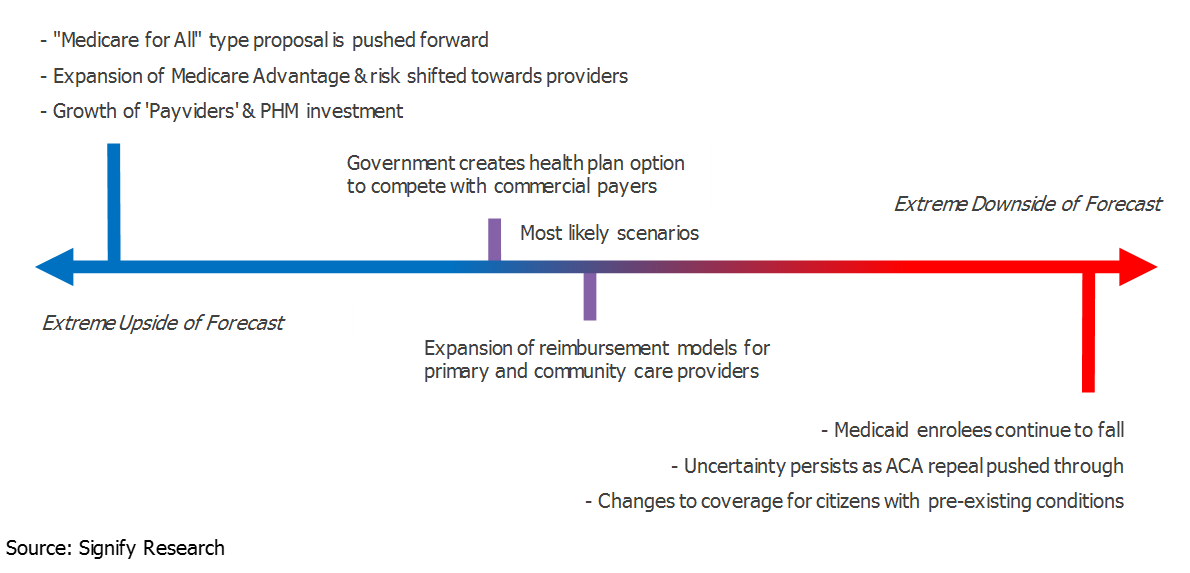

5 – The Future of US Healthcare Provision

The Trump administration has attempted to repeal and reform the ACA during its tenure. In January 2019, open enrolment in Medicaid fell 4% YoY to 11.4M citizens, and while premiums fell marginally this year, they are just under double what they were in 2014. In addition, commercial health plans have raised premiums to cover patients shifting towards Medicaid coverage, reducing its popularity amongst the general population. This will push it high on the agenda for reform in the upcoming 2020 US Presidential Election.

Major uncertainty persists in the US in how to reduce premiums and increase coverage within the current healthcare model. We expect the expansion of new value-based payments to grow through capitation (Medicare Advantage) or bundled payments (Medicare Bundled Payments for Care Improvement/ BPCI). This will drive more value-based contracting and drive additional growth for PHM solutions.

Impact of US Election on PHM Market

About Michael Liberty

Michael Liberty is a Senior Market Analyst at Signify Research working on the digital health team and is responsible for leading the firm’s population health management (PHM) coverage, as well as specializing in the EMR/EHR and RCM markets.