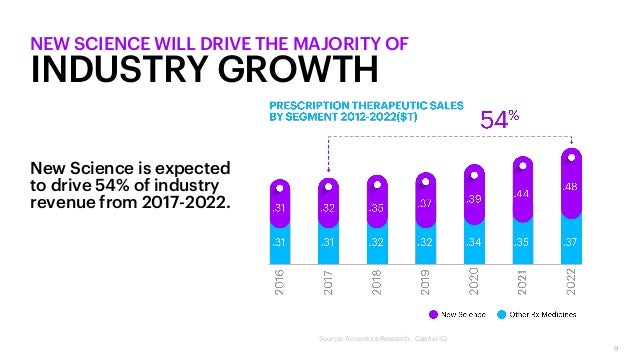

Accenture has released new research that unveils strong evidence that the biopharma industry is facing compressive disruption when a series of innovations, macroeconomic factors, and other changes combine to squeeze profits over a decade or more. However, it also unveils a powerful growth engine: an emerging category that Accenture calls ‘New Science’ that is expected to drive 54% of the biopharma industry’s growth through 2022.

What is New Science?

New Science is an evolving, unique combination of the best in science and health technology (e.g., genomics, biomarkers, companion technologies, delivery methods, etc.) that is filling an unmet need and raising the standard of care.

New Science is the Antidote to Compression

This ‘New Science’ is filling an unmet need to advance the standard of care, and Accenture research found that companies that are leading in New Science are investing six to seven times as much money — US$250 million annually or more — in digital, data and genomics than their peers to develop more precise treatments and interventions that improve patient outcomes.

“The biopharmaceutical industry is at an inflection point where traditional business models are being challenged by declining drug pipeline, pipeline replacement ratios, and the amount of time a product retains its market leadership,” said Stuart Henderson, senior managing director and global lead of the Accenture Life Sciences practice. “This is weakening investor confidence in the industry’s future earnings, indicating it is facing compressive disruption where a series of innovations, macroeconomic factors

The New Science Growth Engine

Accenture’s research shows that companies leading in New Science are escaping the forces of compressive disruption by building the capabilities for exceptional growth. New Science solves for an unmet need through a new mechanism, modality or health technology (e.g., genomics, biomarkers, companion technology) as documented or approved by a regulatory or monitoring agency. Contrary to conventional wisdom, new science is 50% more likely to reach and pass regulatory approval as demonstrated by Probability of Technical and Regulatory Success statistics.

It often requires a new technology companion such as a device or a diagnostic for development or treatment and/or could be a stand-alone technology, such as a mobile diagnostic. Leaders in New Science are investing 6-7 times as much in data, digital and genomics. These investments represent the convergence of science and technology rising to meet the need to deliver better patient outcomes in more economic ways

“New Science is already a huge driver of growth in oncology, but it is also expected to drive exceptional sales growth across multiple other therapeutic areas such as immunology and dermatology, and it exists beyond personalized or precision medicine,” added Henderson.

For more details about how new science is reshaping the biopharma landscape, see the SlideShare report below:

Research Background/Methodology

Accenture conducted pipeline and commercial product analysis for approximately 60,000 total products covered by our data partners, of which 4000 are currently in-market. R&D and regulatory approvals analysis conducted on all clinical programs with phases ending after Jan 1, 2000. Technology investments analysis covered all digital health investments made since 2007.

Approximately 4,000 unique assets were segmented across three dimensions. The first is

Expanded approvals and additional regulatory designations were considered only within 3 years of

This analysis was calculated using the 2012-2018 sales revenue of each asset and forecasting