Digital technologies will transform the health insurance business and early adopters have started to implement new digital business models with initial success, according to a new Research2Guidance report. The report reveals new digital models are changing the way the insurers interact with patients.

For example, digital insurers have reworked the trust equation with the patient, outsourced much of their value chain to their members, and now know much more about them. Digital business models tend to also blur the lines between payer and caregiver organizations. Some of the first-movers already crossed the line and started to offer services which have previously been provided exclusively by doctors and nurses.

The new report “The 10 Disruptive Digital Business Models for Health Insurers” published by Research2Guidance illustrates how startups, health insurance and general payer organizations have started using these technologies to venture into new forms of health insurance offerings and increasingly step into the healthcare provider role.

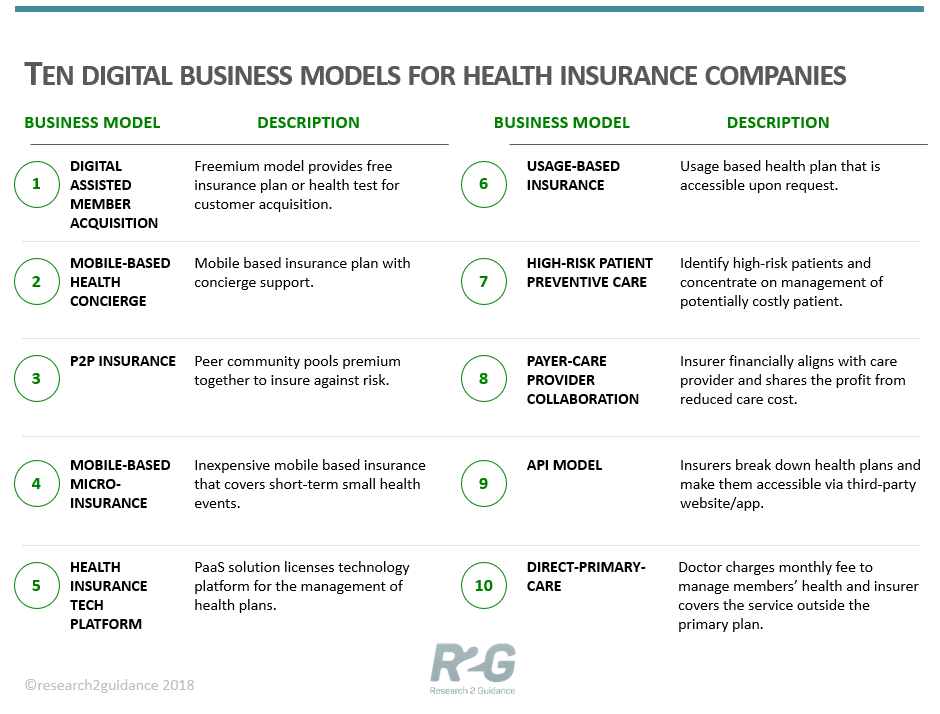

The ten disruptive digital business models that will transform the health insurance business are defined as follows:

1. Digitally assisted member acquisition is a freemium business model concept.

2. Mobile health concierge is a business approach designed for members to complete all health insurance tasks using mobile phones with the support from a concierge team.

3. Peer-to-peer (P2P) insurance refers to a risk-sharing community.

4. Mobile micro-insurance refers to the health insurance plans that cover short-term small health events or minimal ongoing health insurance.

5. Health insurers tech platforms license their technology for the management of health plans and members to their customers.

6. On-demand insurance is a usage-based model that enables members to access desired health plans upon request with the help of a mobile app.

7. High-risk patient preventive care model concentrates on insuring and managing potentially costly patient groups.

8. The payer & provider collaboration model stands for a closer, digitally enabled partnership between payers and care providers, especially hospitals.

9. The API health insurance model uses a list of pre-defined health insurance products accessible to websites and app providers via an application programming interface (API).

10. Direct primary care model. Within this model, a care provider or a hospital act like a health insurance company using a monthly subscription model.

First implementations of these models indicate the positive impact that they have on the company evaluation, the ability to attract new members, the cost structure, and new revenue streams. Currently, the main impact of digital business models is on company evaluation, which reflects the hype some companies have created in the investor community. Companies like Oscar, Clover Health, and Bright Health are valued at over $1 billion USD each after only a few years of operation. The report also profiles first- mover digital implementations. Profiles include their target groups, operating models, service offerings, and early evidence for success where available.

“Startups from the US but also China are the most creative when it comes to using digital technologies to implement new health insurance models” explains Ralf-Gordon Jahns, Managing Director at Research2Guidance. “The majority of the 80 cases that we analyzed for this project have started in those two countries”.