Recently, there’s been an argument about whether digital health (as an industry) is dead, or alive. In some cases, investors have failed to realize rapid returns and companies are struggling to gain traction. Others argue that it’s too early to declare digital health’s death, mainly because of the long sales and technology adoption cycles characteristic of the health market.

This debate is framed within the context of funding levels and investor returns because of how the strength of the digital health market has been traditionally measured.

Each quarter, StartUp Health, Rock Health and other organizations develop highly useful and widely-cited reports focusing on U.S. and global digital health investment activity.

When overall investment volume is high, people celebrate. However, when it dips, many wonder whether the digital health hype cycle is ending. While investment data is certainly valuable, it provides limited information about two other important measures of the digital health market’s strength: implementation and impact.

Currently, there are thousands of organizations, startups, government agencies, universities and others testing, developing and commercializing digital solutions globally. Much of this vital activity is not captured in quarterly investment numbers.

To gain a complete picture of digital health’s strength (or weakness) we need to improve our understanding of its scope, scale and impact. But, how?

Since 2015, I have been leading the collection of what may be the world’s largest source of categorized data focusing on the global digital and emerging technology market. Currently at more than 4 million data points, this intelligence source provides high-value insights about key market events, investment activity, partnerships, pilots, collaborations and other insights illustrating how digital health is being implemented on a daily basis.

Today, I’m pleased to announce the publication of a new resource utilizing this extensive data set: digihealth impact trac.

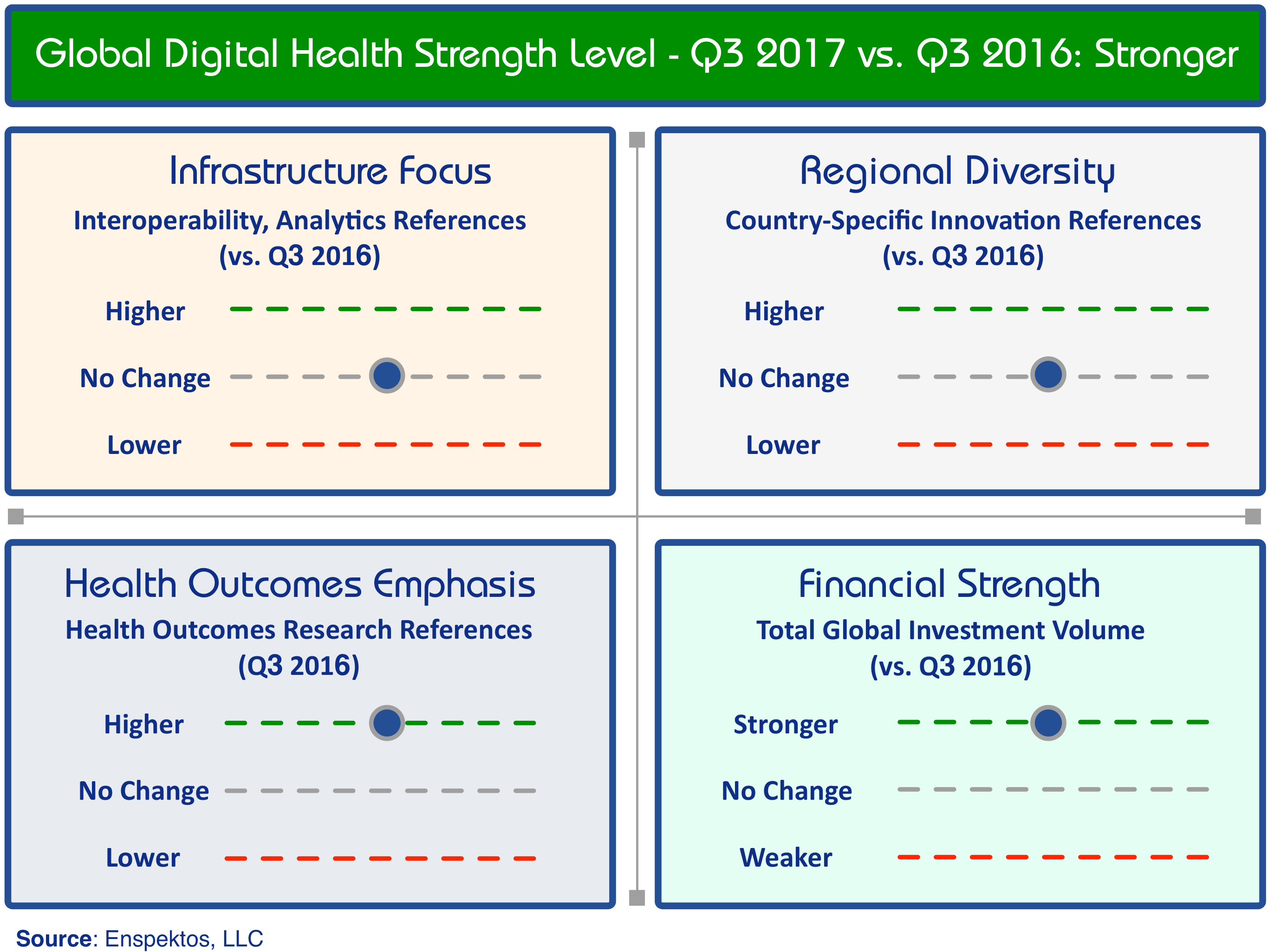

Notably, this quarterly report series features a new metric: The Global Digital Health Strength Index (shown above).

The Index consists of four metrics that, when taken together, provide a holistic picture of how the digital health market is performing globally quarter by quarter.

These are:

–Infrastructure Focus: Whether industry players and others are focused on improving the data pipes and analytics capabilities central to digital health (measured by examining references to these topics in the online digital health literature)

–Regional Diversity: Whether health digital innovations are being adopted and utilized globally (measured by analyzing references to country-specific innovation activity in the online digital health literature)

–Health Outcomes Emphasis: Whether there is a focus on measuring if digital tools improve health outcomes (measured by determining the level of references to clinical and non-clinical outcomes research in the digital health online literature)

–Financial Strength: Overall global digital health funding levels (as measured by StartUp Health)

In addition to measuring the digital health market’s strength, the report features a systematic analysis of how digital tech is impacting health systems, governments, patients and others. This analysis will be repeated quarterly.

It’s my hope that this quarterly report series provides industry observers, decision-makers, patients, providers and others with the information they need to confidently assess digital health’s strength and impact in a multi-faceted and multi-disciplinary fashion.

Access the Q3 2017 edition of digihealth impact trac below: