What You Should Know:

– The first half of 2025 saw a modest increase in digital health venture funding, reaching $6.4B across 245 deals for US-based digital health companies, according to Rock Health’s latest report on H1 2025 digital health trends.

– The numbers is up from $6B in H1 2024 and $6.2B in H1 2023, signaling a steady venture market that has found its footing post-pandemic. Q2 alone brought in $3.4B, exceeding the average of $2.6B per quarter since Q1 2023.

AI Dominates Funding

H1 2025 has been a period of significant “proof points” for the digital health sector, marked by record-breaking AI investments, unprecedented adoption of AI-native provider tools, and the long-awaited re-opening of the IPO market. Despite a stable funding pace mirroring previous years, these validating moments unfolded against a volatile economic and policy backdrop.

Despite fewer deals (245 compared to 273 in H1 2024), the average deal size grew to $26.1M (up from $20.4M in 2024), driven by larger investments in later-stage rounds (Series B-D1) and the significant impact of AI.

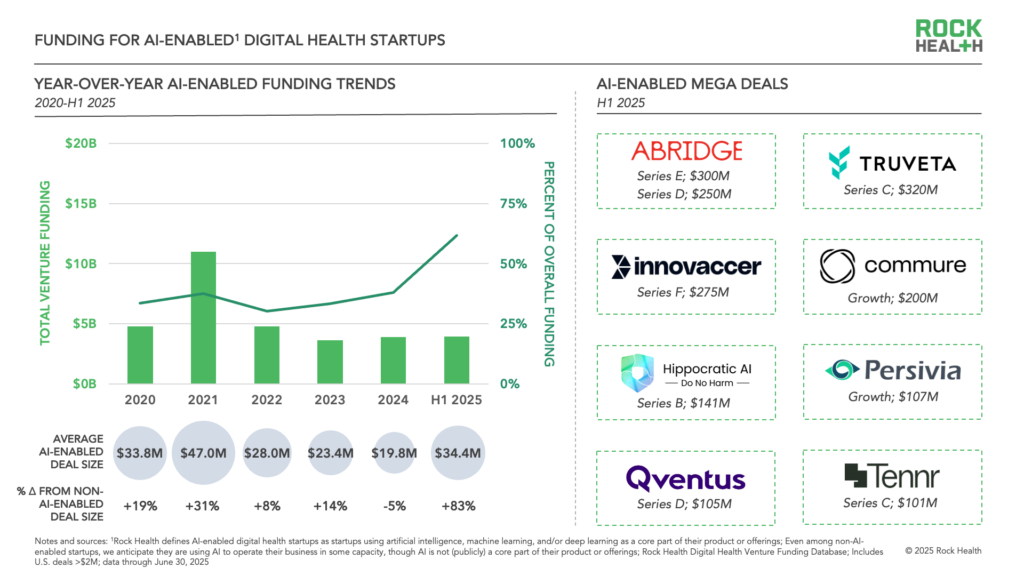

For the first time, AI-enabled startups captured a majority (62%) of digital health venture funding in H1 2025. These companies, on average, raised $34.4M per round—an 83% premium over their non-AI-enabled counterparts (who averaged $18.8 million). This premium was evident across all stages, with Series A and B deals for AI startups commanding significantly higher averages.

The top three funded value propositions were non-clinical workflow ($1.9B), clinical workflow ($1.9B), and data infrastructure ($893M), collectively drawing over half (55%) of overall digital health funding. All these areas are being transformed by AI-enablement and automation. H1 2025 also recorded 11 mega deals (over $100M), with nine of them going to AI-enabled startups, notably Abridge, which closed two mega rounds in four months.

Abridge, an ambient documentation solution, is now deployed at over 100 U.S. health systems and continues to expand its partnerships and use cases, integrating natively into Epic’s workflows as the first “pal” in their Partners and Pals program. Its growth trajectory is further fueled by expansion into RCM, billing, and coding workflows.

Meanwhile, OpenEvidence, an AI-native medical search tool, has become the fastest platform to surpass 100,000 clinician users, adding over 50,000 doctors monthly. Clinicians value its intuitive, chatGPT-style interface and fast, clear, clinically relevant output.

IPOs, Private Equity & Recent Exits

The first half of 2025 also saw exciting exits, primarily from tech-enabled care delivery businesses. Hinge Health launched on the NYSE in May, and Omada Health debuted on the Nasdaq in June, breaking a recent IPO hiatus for digital health. These public market entries offer investors much-needed redemption after a period of drought and tough public market performances.

These companies, like Hinge and Omada, have spent over a decade building evidence bases, earning trust, and optimizing care delivery. They are continuously integrating AI, with Hinge pushing towards automation of care delivery and Omada using AI to augment coaching workflows and recently releasing a consumer-facing AI for nutrition support. Jim Pursley, President of Hinge Health, highlighted AI and computer vision as critical elements that allowed them to “simultaneously improve the member experience and improve our cost structure.”

While these IPOs are celebrated, both companies face continued expectations for sustained profitability and growth. Hinge, for instance, launched with a valuation haircut compared to its 2021 private valuation. Their journeys provide a clearer, though not entirely smooth, path for virtual-first care businesses to achieve durability and scale.

In the M&A landscape, H1 2025 saw 107 deals closed, on pace to nearly double 2024’s total of 121 M&A deals. Digital health companies remain the most frequent acquirers (63% of deals), continuing the “tapestry weaving” playbook to build broader offerings. Meanwhile, private equity (PE) firms are employing a new “roll-up” strategy: combining AI-native startups with legacy healthcare players. The thesis is that established distribution networks and trusted services, when paired with cutting-edge AI, will drive significant efficiency, margin, and scale gains. New Mountain Capital (NMC) has been a key player in this, combining RCM firms with AI tech like SmarterDx and Thoughtful.ai to form Smarter Technologies, and acquiring Machinify to integrate its AI into payment integrity providers.

Health Policy/Regulation Implications

The positive developments in digital health are unfolding amidst significant economic and policy uncertainty. The Trump administration’s “Make America Healthy Again (MAHA)” plan is taking shape, focusing initially on childhood chronic illness. The administration has also issued numerous executive orders on AI deregulation, healthcare price transparency, and lower prescription drug pricing.

The budget bill is a major focal point, introducing Medicaid work requirements and Obamacare marketplace changes that could leave millions uninsured, potentially intensifying uncompensated care losses and shrinking addressable markets. While it includes a modest, temporary increase in Medicare reimbursement, it lacks long-term physician payment sustainability provisions.

For more information, visit https://rockhealth.com/insights/h1-2025-market-overview-proof-in-the-pudding/