What You Should Know:

– Narrow margins, low patient volumes, and high costs fuel ongoing financial instability for U.S. hospitals, health systems, and physician groups, according to two new reports from Kaufman Hall.

– U.S. hospitals and health systems saw mixed performance in March, as national COVID-19 metrics plateaued early in the month before climbing steadily again with increased spread of COVID-19 variants, as shown in the latest issue of the National Hospital Flash Report.

– Physician groups experienced volatility throughout 2020 as a result of the pandemic. Physician productivity, compensation, and revenues for the year all fell below 2019 results. Meanwhile, the average investment required to supplement physician revenues rose, according to year-end analyses featured in the new quarterly issue of Kaufman Hall’sPhysician Flash Report.

Hospital Margins

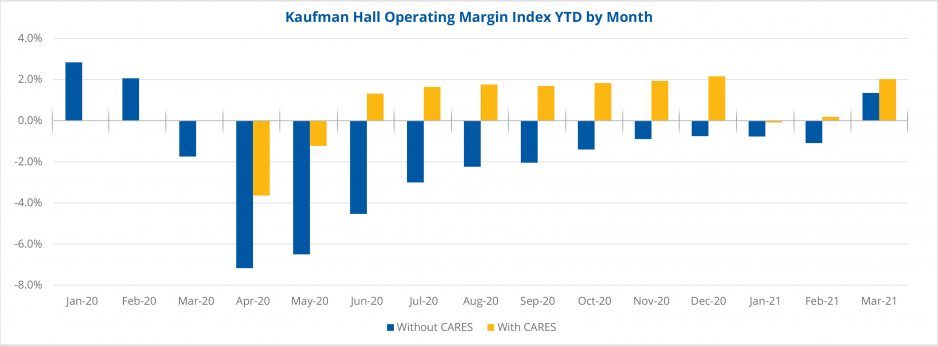

Hospital margins remained narrow. The median Kaufman Hall hospital Operating Margin Index was 1.4 percent, not including federal Coronavirus Aid, Relief, and Economic Security (CARES) Act funding. With the funding, it was 2.0 percent. Hospitals saw year-to-date margins increase in March, while volumes continued to decline.

Revenues and expenses rose across most metrics compared to the first three months of 2020. Operating Margin increased 34.5 percent (2.5 percentage points) year-to-date, not including CARES funding. With the funding, Operating Margin increased 45.7 percent (3.2 percentage points) year-to-date. Year-over-year margin increases were particularly high, largely due to measuring March 2021 performance against the same period last year, when hospitals were hit with devastating losses from national shutdowns and halting of outpatient procedures during the first month of the pandemic. Operating Margin, for example, jumped 128.4 percent or 14.5 percentage points year-over-year in March, without CARES.

Hospital Volumes

Volumes decreased across most metrics year-to-date. Adjusted Discharges were down 7.4 percent and Emergency Department Visits fell 19.2 percent. Operating Room Minutes rose 3.1 percent from January to March compared to the same period in 2020. Gross Operating Revenue (not including CARES) rose 4.4 percent year-to-date, while both Outpatient and Inpatient Revenue rose less than 4 percent. Total Expense per Adjusted Discharge, Labor Expense per Adjusted Discharge, and Non-Labor Expense per Adjusted Discharge all increased about 15 percent compared to the first three months of 2020.

Physician Practices

Physician practices saw some signs of recovery in the second half of 2020, following significant disruption in the early months of the pandemic. The median Investment/Subsidy per Physician Full-Time Equivalent (FTE) fell 26 percent from a high of $289,268 in the second quarter to $213,118 in the fourth quarter, indicating the beginning of a return to pre-pandemic performance.

Net Revenue Per Physician

Net Revenue per Physician FTE fell 6.3 percent from 2019 to a median of $566,773 in 2020 due to pandemic-fueled declines in patient volumes. Total Direct Expense per Physician FTE (including advanced practice providers or APPs) fell 4.9 percent—more than $40,200—from 2019 to $782,518 in 2020. Contributing factors included volume declines that led to lower overall expenses, and reductions in staff availability as many clinicians—particularly female physicians and APPs—had to stay home to care for children and others due to school closures and nationwide shutdowns.