Global venture capital (VC) funding in digital health/health IT, including private equity and corporate venture capital, reach $5.1 billion in the first half of 2019, according to market research firm Mercom Capital. The 1H and Q2 2019 Digital Health (Healthcare IT) Funding and M&A Report reveals $5.1B in funding across 318 deals compared to $4.9B across 383 deals in 1H 2018. Q2 2019 VC funding held strong at $3.1 billion in 169 deals following the $2 billion raised in 149 deals in Q1 2019. This first half of the year is the highest amount raised in the first six months of a year so far.

In addition, the report reveals since 2010, global digital health companies have received $40 billion in VC funding, with U.S. digital health companies at $30 billion.

Other key findings of the report include:

– Total corporate funding in Digital Health companies – including VC, debt, and public market financing – set a new record for the second quarter with $3.3 billion in Q2 2019 compared to $2.2 billion in Q1 2019. In 1H 2019, there was one IPO for $179.4 million.

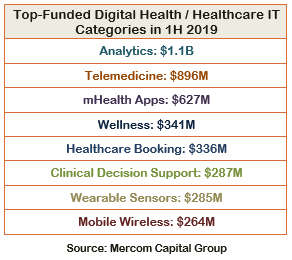

– The top-funded categories in 1H 2019 were: Analytics with $1.1 billion, Telemedicine with $896 million, mHealth Apps with $627 million, Wellness with $341 million, Healthcare Booking with $336 million, Clinical Decision Support with $287, Wearable Sensors with $285 million, Mobile Wireless with $264 million, and Healthcare Benefits with $208 million.

– The top-funded categories in Q2 2019 were: Telemedicine companies with $676 million, Analytics with $551 million, Wellness with $304 million, mHealth

– Apps with $236 million, Wearable Sensors with $226 million, Healthcare Benefits with $208 million, Clinical Decision Support with $180 million, Mobile Wireless with $174 million, and Healthcare Booking with $159 million.

– There were 73 early-stage deals in Q2 2019, compared to 48 deals in Q1 2019.

– A total of 821 investors participated in Digital Health funding deals in the first half of 2019. There were 450 investors that participated in funding deals in Q2 2019, compared to 371 investors in Q1 2019.

– In 1H 2019, there were a total of 91 Digital Health M&A transactions, compared to 116 in 1H 2018. In Q2 2019, there were 46 M&A transactions, compared to 68 M&A transactions in Q2 2018.

– Key M&A transactions in 1H 2019 were: Dassault Systemes acquired Medidata for $5.8 billion, Golden Gate Capital acquired a 51% stake in Ensemble Health Partners for $1.2 billion, Nordic Capital acquired a majority stake in ArisGlobal for $700 million, JPMorgan Chase acquired InstaMed for more than $500 million, Thomas H. Lee Partners (THL) acquired Nextech Systems for $500 million, and Hill-Rom Holdings acquired Voalte for $195 million.