Bruce Johnson, CEO of GHX, outlines four best practices to streamline hospital supply chain management to reduce rising healthcare costs and improve quality.

The supply chain is the second largest and fastest growing expense for providers; with only labor costing most providers more. The supply chain is also very complex. It’s not just about ordering electronically, but also matching contract pricing to order pricing, keeping the data item master clean and current, and validating the product and trading partner information. The supply chain is also a key to creating better end-to-end visibility about all of the products, devices and supplies used in healthcare – critical to running businesses better. In order to avoid the many error-prone points along the way, providers must seek to automate and streamline the supply chain process to find savings- which can reach up to 12 percent of supply chain costs. By finding a unified procurement management solution, a company can find ways to improve revenue streams because it has more oversight into what is being purchased and where the product is going.

Bruce Johnson, CEO of GHX sees working together in a group effort an active contribution to recouping these lost costs. “The ACO [Accountable Care Organization] model will likely encourage hospital network formation by rewarding the healthcare systems that integrate and can reduce costs and improve quality”.

In response to declining reimbursements, hospitals are now working to understand their most profitable service lines and looking for opportunities to form partnerships or actual ownership structures that will allow them to focus on the services they can deliver most cost-efficiently. While looking for efficiency, they are also looking for less profitable service lines that they can outsource to other service providers who have expertise in these areas:

Related: 5 Ways Supply Chain Can Reduce Rising Healthcare Costs

1. Driving Contract Price Visibility and Accuracy

Healthcare providers need improved ways to manage prices for items being purchased both on- and off-contract. Best practices include identifying: products that a provider is frequently purchasing and at what prices; products that are being purchased off-contract; identifying like-products and determining whether or not they can be grouped into contracts for future purchases; and then assimilating those items into group purchasing organization [GPO] or supplier contracts. Utilizing supplier partnerships and strategic alliances can be instrumental in getting these prices for product consistent and under control. A supplier partnership is not a true partnership, but a contract put in place to describe the responsibilities of each company.

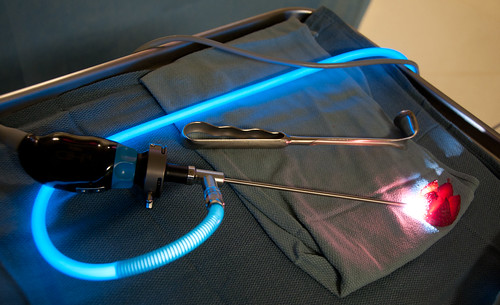

2. Preparing for Unique Device Identifiers

Unique Device Identifiers (UDI) is the latest regulation to hit healthcare. While the initial deadline for compliance is not until 2014, both providers and suppliers need to prepare now for those new requirements in order to create ways to capture the data and most importantly, ways to leverage it. Best practices include: creating new levels of collaboration amongst providers and suppliers to identify ways to capture data needed by their organizations; creating pathways and requirements for data sharing; and creating quality, repeatable processes for data sharing among trusted business partners.

The July 10, 2012 U.S. Food and Drug Administration’s (FDA) long-awaited proposed unique device identification (UDI) rule requires manufacturers to uniquely identify medical devices through distribution and use is one of these global market opportunities. While the rule itself only applies to manufacturers doing business in the U.S., a universal UDI requirement will help healthcare organizations worldwide better understand the role products play in delivering greater value and higher quality outcomes. UDIs make it easier to electronically (and in turn, more accurately and easily) capture data on specific products used at the point of care. This in turn helps providers determine total costs per procedure, increase billing accuracy and improve inventory management.

3. Creating Visibility into Demand Signals and Forecasting

Suppliers need visibility into provider demand for their products. Today, most manufacturers have little visibility into the millions of dollars of product out in the field, and in any business line, there is a necessity to have a projected plan for the future to map where all the money will go. In supply chain management, companies need to be able to forecast production, procurement and logistics. A best practice is to connect the healthcare community with a shared infrastructure to create greater visibility first, then enabling sources of aggregated data for improved demand planning and forecasting. According to the Institute of Business Forecast and Planning, one way to measure the benefits of forecasting is to see how much would have been lost if the forecast was not accurate. Another way to measure it is by how much would have been gained (or saved) with improved forecasts.

4. Ensuring Accurate Product Data and Inventory Repositories

Providers need to be ready to buy the right product and suppliers need to be ready to provide the right product. Best practices include: ensuring accurate data sources for products and product identifiers; continuously enhancing a shared repository of current information; enabling a view of items that providers have in inventory; and providing tracking information of what providers actually use, and in turn, need.

A key driver of new business processes will be compliance with Stage 1 Meaningful Use, which focuses on data capture and sharing. As provider organizations stride toward new business requirements, they can consider the supply chain as a backbone – a key component of technology infrastructure – that can help capture and share the data they need. For example, an organization that is capturing data about all of the medical devices and products used during a patient procedure can then use this data to populate the same information in other locations, such as the electronic health record. In the future, a one-time data capture for a multitude of uses can drive much greater efficiency and compliance.

Saving money in the industry is crucial for better patient engagement and care at any point of contact in the healthcare system. Utilizing these best practices in supply chain management is a good place to start.

“The proof will be in the results, but the promise of being able to put $5 billion back into the industry for better patient care is something we can all get excited about,” concludes Johnson.

Sources:

http://www.ism.ws/pubs/Proceedings/confproceedingsdetail.cfm?ItemNumber=10798

photo credit: timefornurses via cc