What You Should Know:

– A new survey from the Cornell Health Policy Center reveals that 70% of health policy scholars believe converting ACA subsidies into Health Savings Accounts (HSAs) would worsen affordability for enrollees.

– Additionally, 81% of experts agree that ending automatic renewals—a policy slated for 2028 under the “One Big Beautiful Bill Act”—will substantially reduce Marketplace enrollment. These findings come as policymakers scramble to find alternatives to enhanced premium tax credits set to expire at the end of 2025.

The HSA Pivot: A Recipe for Unaffordability?

One of the most prominent alternatives to current subsidies is a proposal by Senator Bill Cassidy (R-LA), which would deposit the incremental value of a household’s ePTC into a Health Savings Account (HSA) rather than applying it directly to the monthly premium.

The theoretical goal is to give consumers more control over their healthcare dollars. The expert verdict, however, is bleak.

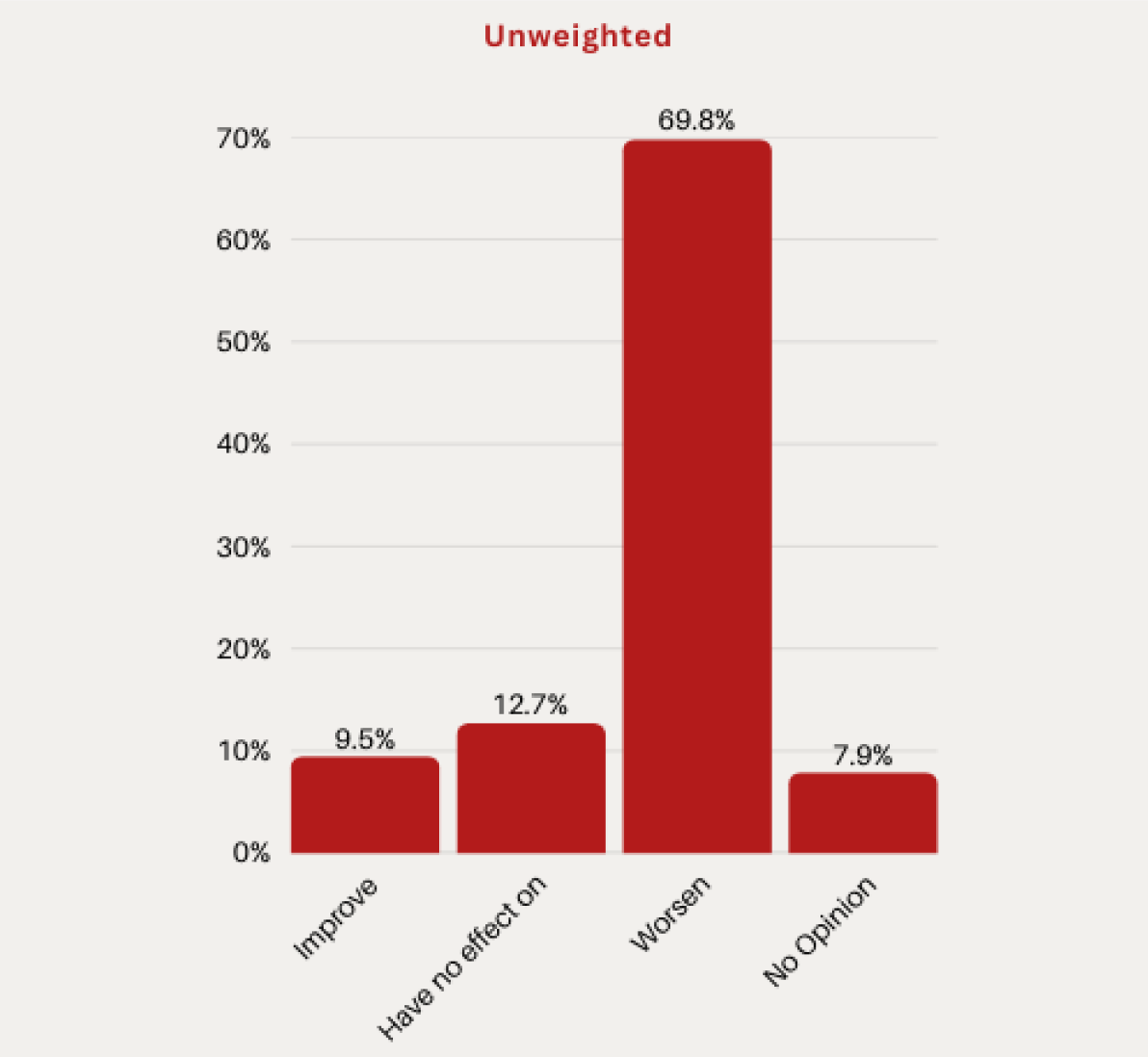

- 70% of surveyed scholars believe this move would “measurably worsen” affordability for Marketplace enrollees.

- Only 10% believe it would improve affordability.

- 13% anticipate no effect.

Critics argue that decoupling the subsidy from the premium exposes lower-income enrollees to cash-flow problems, potentially forcing them to pay higher premiums upfront before accessing HSA funds—a barrier that could lead to widespread disenrollment.

The Friction of “Small-Dollar” Premiums

Another contentious debate centers on the “zero-dollar” premium plans that have become common under the enhanced subsidy structure. Critics argue these plans encourage fraud or allow people to remain enrolled without realizing it. To combat this, some policymakers have proposed a mandatory “token” premium of $5 to $10 per month.

While proponents argue this ensures “skin in the game,” the Cornell panel suggests the cost in coverage loss outweighs the benefit in fraud reduction:

- 75% of experts agreed that nominal premiums would reduce enrollment among eligible individuals who intend to stay covered.

- 70% agreed it would reduce the number of unaware enrollees.

- Only 37% believed it would measurably reduce fraudulent enrollment.

The data suggests that even a $5 hurdle introduces administrative friction—payment processing failures, expired credit cards, or missed mail—that kicks eligible people off their insurance.

The Silent Threat: The End of Auto-Pilot

Perhaps the most significant finding concerns a policy that has already passed. HR 1, known as the “One Big Beautiful Bill Act,” contains a provision effectively ending passive (automatic) renewals for most subsidized enrollees starting in 2028. Currently, if an enrollee takes no action, they are re-enrolled with their subsidy intact.

Under the new law, enrollees must actively re-verify their income and eligibility annually. The consensus on this change was the strongest in the entire survey:

- 81% of respondents agreed or strongly agreed that eliminating passive re-enrollment will “substantially reduce” Marketplace enrollment.

This finding aligns with a growing body of literature on “administrative burden,” which shows that every additional step required to maintain benefits results in a drop-off of eligible participants.

Conclusion: The Trade-off Trap

The survey results highlight a critical disconnect between legislative intent and practical outcomes. While proposals to reduce fraud or increase consumer responsibility appeal to certain political philosophies, the expert consensus indicates they come with a steep price tag: fewer insured Americans and higher barriers to care. As the 2025 deadline looms, policymakers must decide if the pursuit of structural reform is worth the risk of an affordability crisis.