What You Should Know:

– U.S. health systems recorded their strongest financial improvement of the year in November 2025, with median year-to-date operating margins rising to 1.5%, marking the fourth consecutive month of gains.

– Despite this stability, hospitals remain under significant pressure from rising expenses, particularly a 9.3% year-over-year spike in drug costs and increasing financial strain on physician practices. While revenue is growing, high operational costs suggest that 2026 will require continued aggressive resource management.

U.S. Hospital Margins Hit 1.5% in November, Posting Strongest Gain of 2025

For U.S. healthcare CFOs, 2025 has been a year of holding breath. The latest data from Strata Decision Technology suggests they can finally exhale—but only slightly. Data released today reveals that U.S. hospitals and physician practices saw a distinct financial rally in November, posting the year’s strongest month-over-month operating margin gain. However, this recovery is fragile. Beneath the topline improvements lies a persistent, structural problem: the cost of delivering care—specifically regarding pharmaceuticals and physician operations—is rising nearly as fast as the revenue coming in.

The Late-Year Surge

After a sluggish start to the year, health system profitability is showing signs of life. The national median year-to-date (YTD) operating margin climbed to 1.5% in November, up from 1.2% in October.

This 0.3% jump represents the fourth consecutive month of improvement and the most significant monthly gain observed in 2025. For an industry that has operated on razor-thin (and often negative) margins for much of the post-pandemic era, this consistency suggests a stabilizing baseline.

“November’s data suggest that some financial stability may be returning as organizations close out the year, but it’s far too early to declare a turning point,” warned Steve Wasson, Chief Data and Intelligence Officer at Strata Decision Technology.

The Expense Anchor: Drugs and Doctors

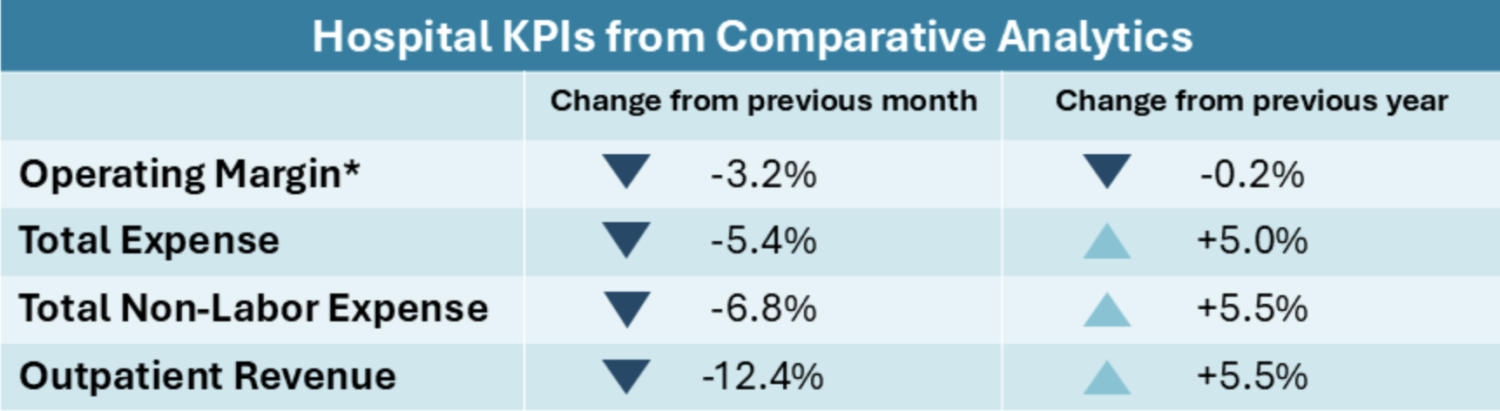

While the margin recovery is promising, the expense side of the ledger remains a critical concern. Total hospital expenses jumped 5.0% year over year (YOY) in November. The primary driver was not labor—which rose a moderate 3.6%—but non-labor expenses, specifically pharmaceuticals.

- Drug Expenses: Up 9.3% YOY, continuing a trend of high-cost therapeutics weighing down hospital supply chains.

- Supply Costs: Up 5.6% YOY.

- Purchased Services: Up 5.5% YOY.

Physician practices are facing an even steeper hill. The data paints a picture of a sector requiring massive subsidies to remain operational. The median total expense per physician full-time equivalent (FTE) has reached approximately $1.1M annualized. This represents an 8.2% jump from 2024 and a staggering 17.5% increase compared to 2023 levels. Consequently, the investment required to support these practices rose 7.4% YOY, forcing health systems to heavily subsidize their ambulatory networks.

Volume shifts: The Inpatient Pivot

November’s volume data highlights a shift in patient behavior that may be bolstering revenue. Inpatient admissions increased 2.0% YOY, driving a 6.4% increase in inpatient revenue. However, the “front door” of the hospital was quieter. Emergency visits declined 2.8%, and outpatient visits dipped 0.2%.

This divergence suggests that while fewer patients are seeking episodic care, those who are admitted require higher-acuity, higher-revenue services. Regional disparities persist, with the Northeast and South capturing the bulk of inpatient growth, while the Northeast simultaneously saw declines in outpatient traffic.

Outlook for 2026

As health systems prepare their 2026 budgets, the strategy appears to be shifting from “survival” to “alignment.” With gross operating revenue up 5.3%, the money is moving, but efficiency remains elusive.

“Leaders will need to remain focused on aligning resources to where demand is strongest while continuing to reassess cost structures entering 2026,” Wasson noted.

The data indicates that the “do more with less” era is over; it has been replaced by the “pay more to do more” era. Success in 2026 will likely depend on a system’s ability to control non-labor spend—specifically drug costs—while managing the skyrocketing investment required to keep physician practices open.