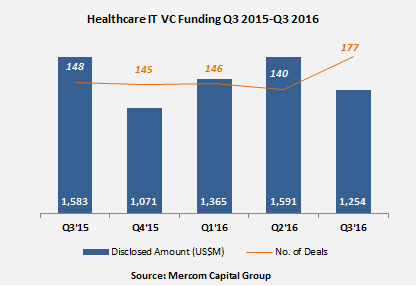

Healthcare IT VC funding topped $1.25 billion in 177 deals in Q3 2016 compared to $1.6 billion in 140 deals in Q2 2016, according to the latest report from Mercom Capital Group. The report, Q3 2016 Healthcare IT / Digital Health Funding and M&A Report reveals that overall funding is on pace to eclipse 2015’s total and the trend from last quarter continued as there was again increased funding activity in Healthcare IT outside of the United States, especially in China.

Here are ten key trends to know from the Mercom’s latest report:

1. Among U.S. states, California more than tripled the VC funding of any other state and was followed by Massachusetts, Pennsylvania, Virginia, and Illinois.

2. So far this year, more than $4.2 billion has been raised in 463 deals, well north of the $3.6 billion raised during the same period in 2015.

3. There were 118 VC funding deals involving U.S. companies in Q3 2016 and 59 deals with companies from other countries around the world. In Q2 2016, 108 VC funding deals were recorded in the U.S. and 32 in the rest of the world.

4. There were 87 deals that were $2 million or below, including 47 Accelerator/Incubator deals in the third quarter of 2016. This is a significant increase from Q2 2016 when there were just 43 deals that totaled $2 million or below with only 12 Accelerator/Incubator deals.

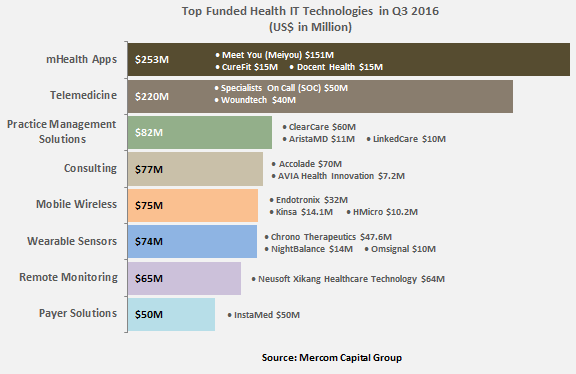

Top Funded Health IT Technologies in Q3 2016

5. Healthcare consumer-centric companies raised $851 million in 128 deals, accounting for 68 percent of the total $1.25 billion raised in Q3 2016 compared to $1.2 billion in 95 deals in Q2 2016. Healthcare practice-centric companies secured 32 percent of the funding with $404 million in 49 deals, compared to the $360 million raised in 45 deals in Q2 2016.

6. The top funded areas were mHealth apps with $253 million, Telemedicine companies with $220 million, Practice Management Solutions companies with $82 million, Consulting companies with $77 million, Mobile Wireless with $75 million, Wearables and Sensors with $74 million, Remote Monitoring with $65 million and Payer Solutions companies with $50 million.

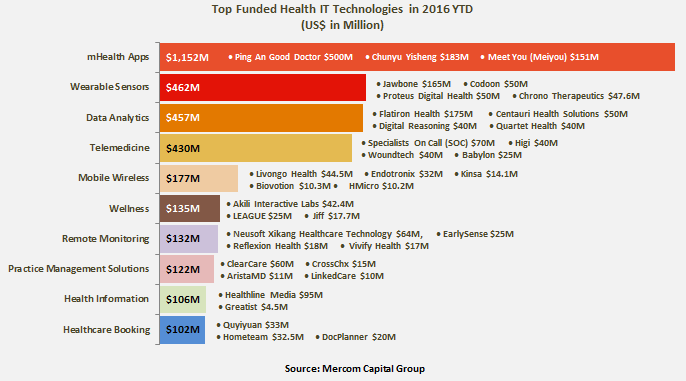

Top Funded Health IT Technologies in 2016YTD

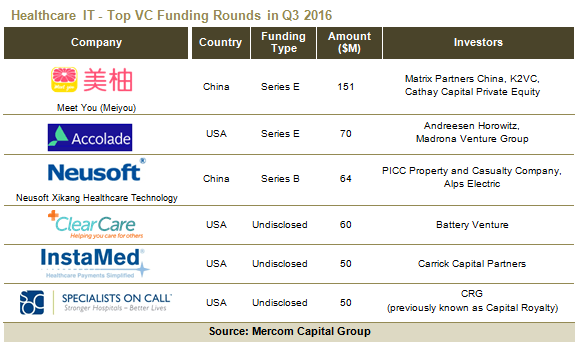

7. The top VC deals for Q3 2016 included:

– Meet You, provider of a social, health, and fertility tracking app for women which raised $151 million

– Accolade, developer of a mobile app for professional health concierge services, secured $70 million

– Neusoft Xikang Healthcare Technology, provider of a remote health monitoring device for individuals and families, which raised $64 million

– ClearCare, provider of an online software platform for the home care industry, secured $60 million

– InstaMed, a Healthcare Payments Network that simplifies every healthcare clearinghouse and payment transaction for providers and payers all in one place, raised $50 million

– Specialists On Call (SOC), a provider of specialty physician consultations to acute care hospitals via telemedicine, raised $50 million.

Healthcare IT – Top VC Funding Rounds in Q3 2016

8. A total of 309 investors participated in Healthcare IT deals in Q3 2016 with 13 investors participating in multiple rounds. Bessemer Venture Partners and Canaan Partners were on top with three deals each.

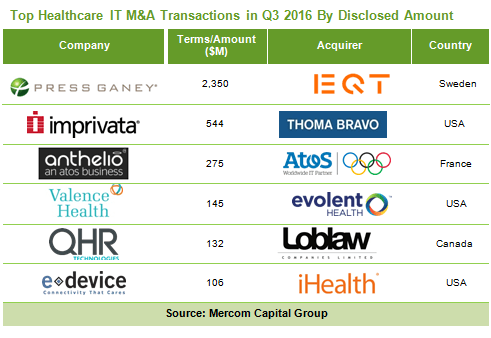

9. There were 53 M&A transactions (16 disclosed) involving Healthcare IT companies in Q3 2016, compared to the same number of transactions (seven disclosed) the previous quarter. Merger and acquisition activity was led by Mobile Health Apps with eight transactions, Practice Management Solutions companies tallied five, and Data Analytics, Population Health Management, and Remote Monitoring companies had four transactions apiece.

Top Healthcare IT – M&A Transactions in Q3 2016

10. The top disclosed M&A transaction was the $2.35 billion acquisition of Press Ganey Associates by EQT Equity fund EQT VII. Other large transactions included:

– Thoma Bravo which acquired Imprivata for approximately $544 million and took the company private

– Atos acquired Anthelio Healthcare Solutions from its shareholders Actis and McLaren Health Care Corporation for an enterprise value of $275 million

– Evolent Health’s acquisition of Valence Health for $145 million

– Loblaw Companies acquired QHR Corporation for $132 million

– iHealth Labs’ acquisition of eDevice for $106 million

mHealth Apps and Data Analytics companies have been involved in the most M&A transactions so far in 2016 with 19 and 15 transactions respectively.