Healthcare faces a paradox: while clinical care embraces digital transformation, critical back-office financial processes, particularly disbursements, often lag behind. It’s common knowledge that modernization is key; yet even as many providers receive payments electronically, outbound funds like patient refunds frequently rely on inefficient paper checks. This reliance on outdated methods signifies deeper operational issues hindering financial health.

Over the past decade, companies have commendably invested in elegantly and efficiently accepting funds to maximize the speed of revenue and have worked to automate business-to-business expenses. However, a significant unmet opportunity lies in the realm of payments to consumers. Many organizations have established dedicated departments to manage their revenue cycle and modernize how they accept payments. Yet, when it comes to refunds and other consumer-directed payments, legacy solutions often remain entrenched. A primary driver for this is that many payors do not know if consumers, payees, or recipients have a bank account, leading them to default to checks. The future, therefore, lies in meeting recipients where they want to be met: with digital-first solutions that are ubiquitous, allowing them to spend funds immediately or easily send them to their bank account or digital wallet.

Despite the proven benefits of digital approaches, the complexity of managing financial operations, whether handled internally or through external partners, can sometimes perpetuate these manual workflows for disbursements. However, modern disbursement solutions offer more than just digitization. The compelling ROI is found in significant operational efficiencies, robust risk mitigation (covering compliance and security), vastly improved patient financial experiences, and strong alignment with the broader transformation occurring in healthcare. Modernizing disbursements is a strategic move, enhancing value across the entire organization.

The Hidden Costs and Operational Drag of Legacy Disbursements

Paper checks for patient refunds and other consumer payments impose significant costs and administrative burdens. Manual tasks such as printing, mailing, tracking, handling inquiries, and reconciliation consume valuable staff time within departments focused on financial operations. These teams are often already strained by complex billing processes, payment denials, and persistent labor shortages. Industry observations suggest that staff can spend a substantial portion of their time on paperwork, a situation exacerbated by inefficient payment processes.

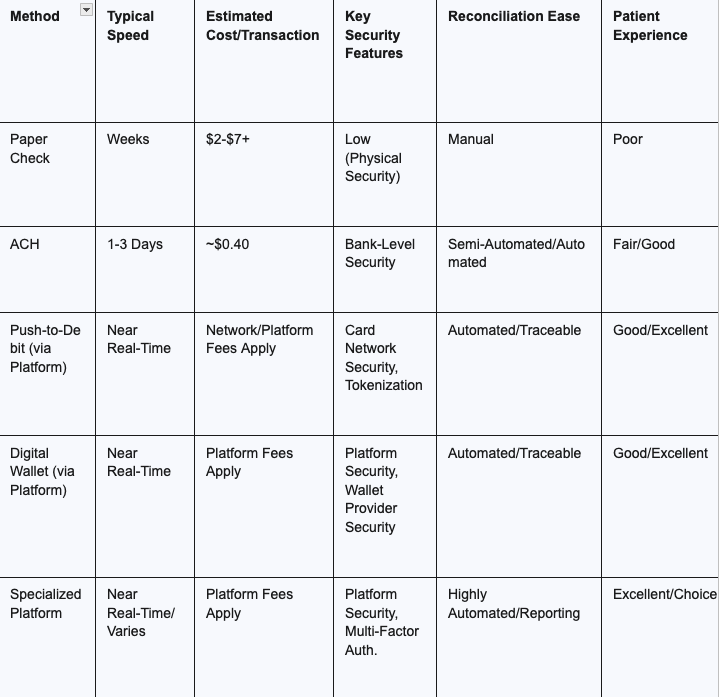

The direct cost of issuing a paper check is considerable, typically ranging from $2.01 to over $7 per transaction. This stands in stark contrast to the approximate $0.40 cost for electronic methods like ACH. With manual processes still prevalent in many areas, the potential for savings is immense. Beyond these direct costs are the opportunity costs: staff time diverted from higher-value activities that could improve financial outcomes or patient engagement. Furthermore, the slow processing time for checks, which can take weeks when factoring in mail delivery and clearing, negatively impacts cash flow.

Critically, legacy disbursement methods also detract from the patient experience. In an era where consumers expect digital convenience and immediacy in their financial interactions, delays or confusion with check-based refunds cause frustration, erode trust, and increase the volume of service calls. This is particularly relevant as many payors default to checks simply because they lack information about a recipient’s banking status. Patient preference for instant or near-instant disbursements has surged, with some industry reports indicating a near doubling in this preference from 2023 to 2024. In a healthcare landscape characterized by increasing patient financial responsibility, a poor refund or payment experience can damage an organization’s reputation, risk patient attrition, and contribute to bad debt.

Unlocking Operational Efficiency: The Core ROI of Modern Solutions

Modern digital disbursement solutions streamline workflows, substantially cut costs, and significantly enhance the user experience for both the payor and the payee. Platforms leveraging proprietary technology automate the entire disbursement process. Key features often include API integration with existing financial, practice management, or Electronic Health Record (EHR) systems (which helps avoid data silos and error-prone manual data entry), user-friendly portals for staff, and real-time reporting capabilities.

Crucially, these solutions offer choice in payment modalities, such as push-to-debit card, ACH direct deposit, and digital wallets. This directly addresses the challenge of meeting diverse consumer preferences and the reality that payors may not know individual banking situations. By providing options, organizations can meet recipients where they are, allowing them to choose how they want to receive their funds for immediate spending, transfer to a bank, or deposit into a digital wallet. This optimizes for speed, recipient satisfaction, and cost-effectiveness.

Comparison of Disbursement Methods in Healthcare

Sources: afponline.org, premierinc.com, tipalti.com, oracle.com, pymnts.com, oneinc.com, billtrust.com, xifin.com, djholtlaw.com, healthlifesciencesnews.com, bdo.com, adamsbrowncpa.com, coverself.com

Quantifiable gains include direct cost savings, potentially $3 or more per transaction when compared to paper checks, and significant overall reductions in payment processing costs. Studies focusing on broader payment automation suggest that digital solutions can cut these operational costs substantially. Automation also frees up staff time, accelerates reconciliation processes, and positively impacts wider financial operational metrics, mirroring the efficiency gains seen in other areas where automation has been applied to revenue-related functions.

Addressing Critical Compliance and Security Challenges

Modern disbursement solutions also play a crucial role in mitigating two major risks: abandoned property (escheatment) compliance and payment fraud.

- Abandoned Property: Unclaimed property is a growing and complex burden for healthcare providers, often stemming from intricate transaction histories and potential overpayments. State audits are on the rise, and penalties for non-compliance can be severe. Managing escheatment internally demands significant resources and expertise. Modern disbursement platforms aim to simplify compliance by maximizing the success rate of digital delivery, tracking recipient engagement, and assisting with the legally required notification and remittance processes if funds remain unclaimed. Addressing this burden proactively offers significant risk mitigation.

- Payment Fraud: Paper checks are notoriously vulnerable to fraud; a high percentage of organizations report experiencing check fraud activity, frequently linked to mail theft. Digital disbursement methods drastically reduce this exposure through robust security measures such as encryption, multi-factor authentication, tokenization, and secure verification processes. Platforms that adhere to stringent standards like HIPAA, PCI-DSS, and SOC ensure that sensitive data is handled securely. This not only combats the risks associated with physical check fraud but also protects against potential PHI exposure and related HIPAA penalties.

- Reconciliation & Auditability: Digital platforms automate the reconciliation process, enabling finance teams to quickly match transactions and identify any discrepancies. This improves cash flow management and generates clear, comprehensive audit trails, which simplifies month-end or year-end closing procedures and supports overall financial transparency.

Quantifying the Full ROI: Metrics from the Field

The full ROI of modernizing disbursements encompasses both easily quantifiable financial benefits and less tangible, yet equally important, strategic advantages.

- Direct Cost Reduction: Savings of $3-$6+ per transaction compared to checks can lead to substantial overall reductions in processing costs, aligning with the savings observed in other financial operations automation projects.

- Efficiency Gains: Payment timelines can shrink from weeks to near real-time, improving cash flow velocity and freeing up staff from manual payment processing to focus on more strategic tasks.

- Risk Mitigation Value: Avoiding the financial and reputational costs of check fraud (which affects a large percentage of organizations) and the substantial penalties associated with escheatment non-compliance represents significant, though sometimes harder to precisely quantify, financial value.

- Patient Satisfaction & Retention: Offering speed, convenience, and choice in how patients receive payments enhances their overall financial experience. This can drive loyalty, improve satisfaction scores, and potentially reduce patient churn.

Industry collaborations are increasingly focused on streamlining healthcare disbursements through the adoption of digital technology. Analogous automation projects in other complex financial areas have demonstrated the potential for multi-million dollar annual savings. A comprehensive ROI calculation must therefore include the value of an enhanced brand reputation, increased patient loyalty, and the significant cost avoidance achieved by reducing fraud and regulatory risks. The ROI is particularly compelling for organizations that process large volumes of refunds or deal with complex, multi-party payment scenarios.

Strategic Alignment: Connecting Disbursements to Healthcare Transformation

Modernizing disbursements is not merely an operational upgrade; it is a strategic imperative that aligns with several key shifts occurring within the healthcare industry.

- Healthcare Consumerism: It directly meets the growing patient demand for digital convenience, speed, and choice in all their financial interactions. This is crucial for satisfaction and fostering long-term loyalty.

- Value-Based Care (VBC): Efficient digital disbursements help reduce administrative waste and lower the costs associated with collections and payments, supporting the operational rigor and financial discipline required for successful VBC models.

- Interoperability: Modern disbursement platforms are typically designed for integration (often via APIs) and can connect seamlessly with existing EHR, practice management, and financial systems. This helps break down data silos and enables greater automation.

- Payment Integrity & Transparency: Digital disbursements provide clear, easily traceable payment records. This supports broader goals around payment accuracy and contributes to the industry-wide push for greater financial transparency.

Furthermore, the data generated by these advanced disbursement platforms can offer valuable strategic insights, enabling organizations to optimize workflows, tailor patient communications more effectively, and improve financial forecasting.

The Imperative for Modernization

Modernizing healthcare disbursements delivers a multifaceted and compelling ROI, encompassing operational efficiency, robust risk mitigation, enhanced reconciliation processes, and significantly improved patient financial experiences. It is also a strategic necessity, providing foundational infrastructure that supports the ongoing evolution towards greater healthcare consumerism, value-based care, interoperability, and payment integrity.

Relying on outdated disbursement processes is a continuous financial drain, a notable compliance risk, and an increasing competitive disadvantage. Healthcare financial leaders must strategically evaluate and embrace comprehensive digital solutions. Adopting modern payment technology is no longer just an option—it is essential for building an efficient, secure, compliant, and patient-centric financial future for healthcare organizations.

About Stephen Faust

Stephen Faust is the Chief Executive Officer of Dash Solutions, a leading innovator in the digital payments and financial technology sector. With more than 20 years of experience in fintech, digital banking, and scalable payment infrastructure, Stephen is a recognized thought leader at the intersection of modern technology and financial inclusion.

In 2007, Stephen joined Dash Solutions (then, Prepaid Technologies) to scale the business and carry out the vision of Tommy McCulley, Founder and Chairman. Since assuming his role as CEO in 2018, Stephen has led the company’s evolution into a trusted leader in business-to-business payments and engagement technology, delivering secure, seamless, and real-time payment solutions. Under Stephen’s leadership, the company has experienced remarkable, double-digit, year-over-year growth and has accelerated revenue by 25x since 2011. Stephen directed the acquisition of Karmic Labs, WorkStride, and Kyck Global, expanding the company’s platform and capabilities, while also securing $96M of growth equity capital from Edison Partners in 2021.