What You Should Know:

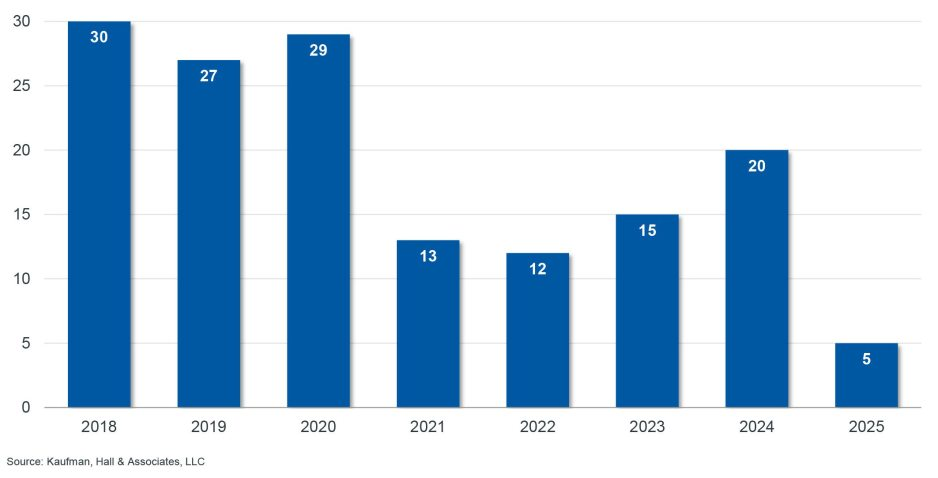

– Mergers and acquisitions (M&A) activity for hospitals and health systems in the United States experienced a significant slowdown in the first quarter of 2025, according to a recent analysis by Kaufman Hall.

– The number of announced transactions reached a historic low, with only five deals recorded. Four out of the five transactions involved financially distressed organizations revealing broader market volatility and economic uncertainty, including concerns about tariffs and potential policy changes.

Q1 2025 Health M&A Activity

While hospital and health system M&A activity had been on an upward trend since 2021, Q1 2025 saw a sharp reversal. The five announced transactions represent the lowest figure in recent history, even falling below the low point observed during the COVID-19 pandemic.

Furthermore, the transactions in Q1 2025 were characterized by smaller deal sizes. There were no “mega mergers,” and the average size of the smaller party involved in the transactions was considerably lower than in previous years. This combination of fewer transactions and smaller deal sizes resulted in a total transacted revenue significantly below recent trends.

In terms of acquirer types, Q1 2025 saw a mix, including for-profit, religiously affiliated, and not-for-profit entities. The downturn in hospital and health system M&A activity aligns with broader trends in global and U.S. M&A markets. Global data indicates a rise in deal value driven by a few large deals, but a decrease in the overall number of transactions. U.S. data also reflects a decline in M&A activity.

Health M&A Slowdown Key Drivers

This slowdown is attributed to economic volatility and uncertainty, including factors such as:

- Concerns about a potential global trade war due to tariffs.

- Geopolitical uncertainty related to conflicts.

- Policy proposals at the state and federal levels that could impact the healthcare sector.