The digital respiratory market is still at an emerging stage, with players positioning themselves to be ready when the market will take off, according to Research2Guidance’s “The Global Digital Respiratory Solutions Market 2009-2023” report. The report describes in detail the current digital respiratory market status, digital service offerings, connected devices, service offerings, perceived strategies of key market players, key trends, market barriers, and future revenue streams.

In addition, the report reveals many digital offerings are still at the stage of formation, whereas others are yet to be commercially launched. However, the digital respiratory ecosystem has established itself and is set to expand.

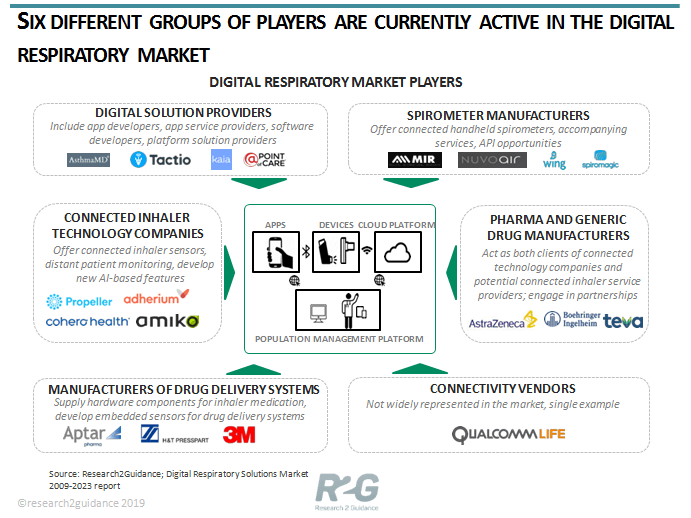

6 Different Groups of Players Active in the Digital Respiratory Market

Chronic respiratory diseases affect around 500 million people globally presenting a huge opportunity that has not yet been properly addressed. there are now about 300 companies of various sizes and backgrounds currently available in the respiratory market. The report divides them into six general categories:

1. Digital solution providers

Their offerings are mainly based around a mobile app. As a result, they dominate the mobile respiratory segment, accounting for about 80% of the total respiratory apps available in mobile app stores. Digital solution providers are also the most diverse group of players, which includes app developers, app service providers, software developers, platform solution providers, etc.

The most illustrative examples of such solution providers include Asthma MD, Kaia Health Software, @Point of Care, Qurasoft, etc. As a rule, the companies from this category do not produce any hardware. However, some of them can offer connectivity opportunities by engaging third-party devices.

2. Connected inhaler technology companies

This category is focused on developing connected inhaler sensors, mostly as add-on solutions to existing device-drug combinations. These inhaler sensors are connectable to cloud platforms to enable distant patient monitoring and provide it as a SaaS service. Apart from that, some connected inhaler technology companies develop new AI-based features, which will be able to deliver more personalized and enriched services. Propeller Health, Adherium, Cohero Health, and Amiko are the most prominent leaders in this category.

Propeller Health has emerged as an outstanding leader in this category highest number of partnerships with pharma companies, so its add-ons cover nearly the whole range of the currently available types of inhalers: MDIs, diskus products, respimats, and ellipta inhalers. Due to the partnership with GSK, Propeller Health’s portfolio includes such the world’s top inhaled corticosteroid drugs as Advair and Flovent. The company has also succeeded in reaching to research institutions and healthcare organizations.

3. Manufacturers of connected handheld spirometers

Offers handheld spirometers featuring Bluetooth connectivity and data synchronization with a mobile app. For a long time, spirometry solutions have been associated with the clinical environment, whereas in the homecare cheap and functionally limited peak flow meters were recommended to patients for measuring lung function.

Manufacturers of connected handheld spirometers offer API opportunities for potential partners, as well as their own mobile app solutions. Companies from this category include NuvoAir, Medical International Research (MIR), Sparo Labs, etc. NuvoAir is currently the only spirometer company that offers a vertically integrated patient monitoring solution, which includes devices, apps, and a clinical dashboard.

4. Pharmaceutical companies and generic drug manufacturers

Pharmaceutical companies and generic drug manufacturers are both clients of connected inhaler technology companies and potential connected inhaler service providers. The pharma sector is currently the major driver behind the adoption of connected inhaler solutions.

Currently, several leading pharma companies are engaged in developing connected inhaler solutions either via partnerships with connected inhaler manufacturers (AstraZeneca, Novartis, Boehringer Ingelheim, GSK) and connectivity vendors (Novartis, Boehringer Ingelheim) or via direct acquisitions (Teva).

5. Manufacturers of drug delivery systems

Manufacturers of drug delivery systems include traditional suppliers of hardware components for inhaler medication, such as Aptar Pharma, HT Presspart, Vectura, and 3M. Looking for value-adding opportunities, these companies are engaged in developing embedded sensor solutions for drug delivery systems, cooperating with connected inhaler technology companies and pharma companies.

6. Connectivity vendors

Connectivity vendors are not yet widely represented in the digital respiratory market, with Qualcomm Life, a subsidiary of Qualcomm being the only example. Since 2016, Qualcomm Life has partnered with Novartis and Boehringer Ingelheim to develop the new generation of connected inhaler drugs, without radically changing their existing design.

Conclusion

Future growth in the digital respiratory market should attract new types of players such as service providers (both in-app and external ones), AI enablers, and big data solution providers. If momentum in the market continues, it is expected to attract big internet companies, looking for opportunities to diversify their portfolio and create new value streams.