Spending growth in the $2.9 trillion US health economy is expected to slow in 2016 as compared to 2015; however, it will still outpace overall economic inflation. Stock prices, earnings reports and the customer base have increased and that means the industry is financially healthy. Sadly, affordable healthcare remains out-of-reach for many consumers.

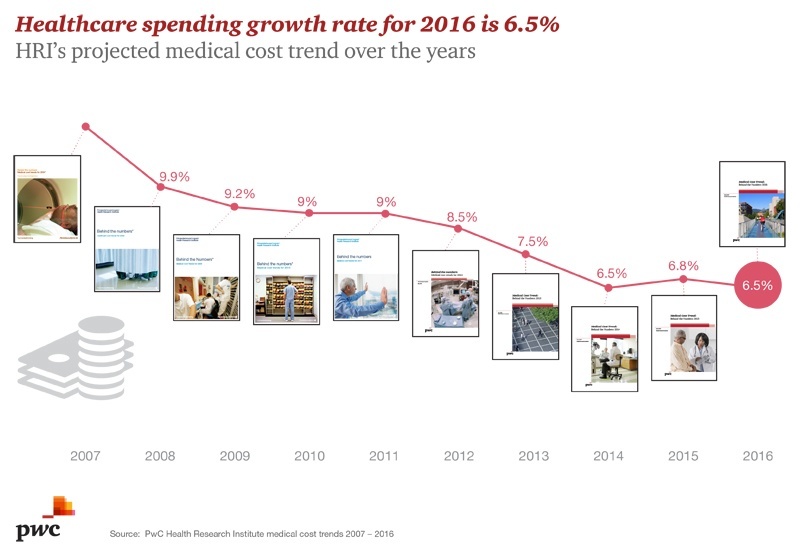

PwC’s Health Research Institute (HRI) projects the U.S. healthcare spending growth rate will dip to 6.5 percent in 2016, capping a ten-year trend of slowing employer medical cost-trend growth in the employer-sponsored market. For this research, HRI interviewed industry executives, health policy experts and health plan actuaries whose companies cover more than 100 million employer based members. HRI also analyzed results from PwC’s 2015 Health and Well-being Touchstone survey of more than 1,100 employers from 36 industries and a national consumer survey of more than 1,000 US adults.

Deflators

The HRI annual report Medical Cost Trend: Behind the Numbers, identifies three factors that are expected to reduce the medical growth rate in 2016:

1. The Affordable Care Act’s looming “Cadillac tax” on high-priced plans which is accelerating cost-shifting from employers to employees to reduce costs;

2. Greater adoption of “virtual care” technology that can be more efficient and convenient than traditional medical care; and

3. New health advisers helping to steer consumers to more efficient healthcare.

Inflators

Despite the year-over-year slowdown, HRI also reported that medical inflation still outpaces general inflation, underscoring the challenges ahead for the health industry. In fact, Behind the Numbers identified two factors that will likely exert inflationary pressure on health spending in the year ahead:

1. New specialty drugs entering the market in 2015 and 2016 will continue to push health spending growth upward; and

2. Major cyber-security breaches are forcing health companies to step up investments to guard personal health data, adding to the overall cost of delivering care.

“While the health industry has improved in efficiency over the past decade, the slowing employer medical cost growth is due to the increased role of savvy health consumers facing higher cost-sharing responsibilities and more complex decisions,” said Kelly Barnes, PwC’s U.S. health industries leader. “This will continue to impact the New Health Economy in the coming years.”

After accounting for likely changes in benefit design, such as higher deductibles and narrow networks, HRI projects a net growth rate of 4.5 percent in 2016. Benefit design changes typically hold down spending growth by shifting financial responsibility to consumers, who often choose less expensive options.

Projecting medical cost growth rates – a 10-year perspective

When HRI made its first projection of healthcare spending, the growth rate for 2007 was almost 12 percent. The trend rate went down in 2008 but remained high for the next four years. Four key cost growth factors HRI has observed over the past decade:

- The healthcare-spending trajectory has leveled off but is not declining;

- Cost sharing slows consumer use of health services;

- Curtailing inpatient care lowers costs; and

- The ACA has had minimal direct effect on employer health costs.

Business Impact

More Americans with health insurance and an improving economy have not increased the medical spending trajectory. Structural changes have helped keep costs in check. But there is still much to be done as long as health spending continues to outpace gross domestic product and individual consumers and companies struggle to afford services. Health companies must restrain costs when bringing new cures and technology to consumers.

Employers must pursue strategies that not only strengthen their bottom line but better equip workers to make informed health decisions – or they will all pay a high cost in the long run. User-friendly technology offers opportunities for greater transparency, remote care delivery and true comparison shopping.