New IDC Health Insights reports highlights the high growth opportunity of the emerging population health management market as the industry focuses on big data.

The population health management vendor market (PHM) is poised for high-growth opportunities, according to a new report by IDC Health Insights. According to the study, vendors have reported adding an average of 10-15 new clients in 2013 and expect this trend to continue for the next 18 to 24 months. Physician group practices represent the majority of clients in this market, with integrated delivery systems and payers representing a smaller share of the market.

A Handful of Early Market Leaders

With the increasing shift towards value based healthcare, many healthcare executives are finding population health management solutions as a key driver to achieving the goals of the Triple Aim. Early market leaders evaluated in this report include: Covicint, eClinicalWorks, Explorys, Kryptiq, Lumeris, McKesson, Medecision, Optum, The Advisory Board Company, and Wellcentive.

With only a handful of market leaders, the market demands are so dynamic that we will likely see new entrants in the PHM market. With the exclusion of just two vendors, the rest of the vendors are owned by companies with multiple healthcare applications or horizontal technology suppliers. As a result consolidation of the market is likely to be slow.

Can Anybody Define Population Health Management?

Designed to help healthcare executives define the emerging and confusing PHM market, one of the drivers of the report is to establish a common definition and vendor inclusion criteria to provide clarity to healthcare executives before investing in technology.

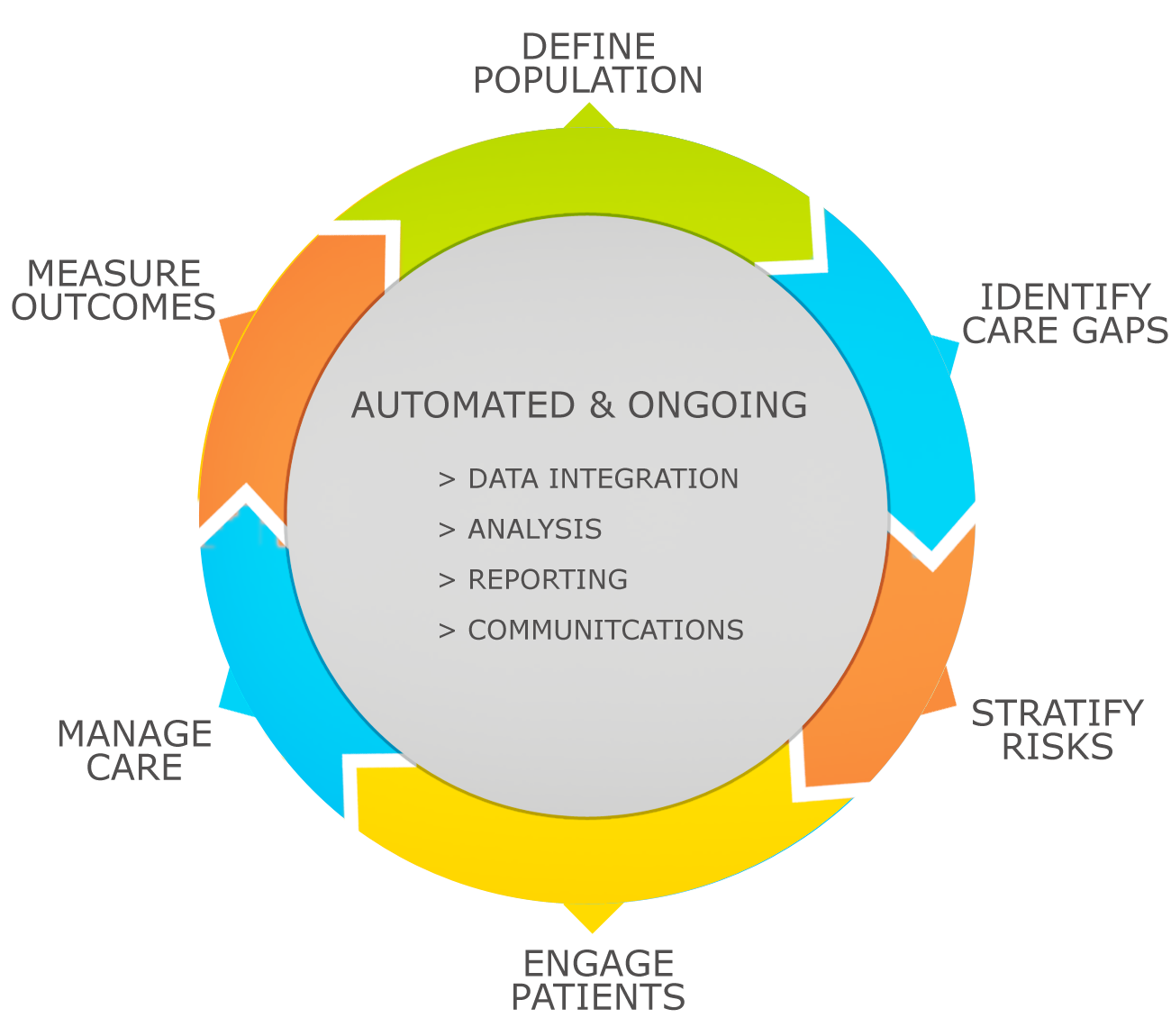

Population health management as defined by IDC Health Insights includes functionality to identify populations at risk or predicted to be at future risk, the ability to create and monitor care plans, and finally the ability to communicate with communities of patients as well as with individual patients.

Providing Signal to Noise for Healthcare Providers

With only a small group of PHM vendors actively supported this market, it is critical for healthcare providers to recognize the growing group of other vendors that do not provide full PHM functionality. These vendors only support certain key pillars of population health management. These key differentiators include:

- the depth and breadth of analytic capability (patient risk identification and performance measurement), the degree of integration with Electronic Health Records, and the sophistication of care plan development.

- The ability to have data driven but configurable care paths is an efficient way to begin the care planning process.

According to IDC Health Insights, it is critical that buyers articulate their business goals before they select a vendor. Vendors in this IDC MarketScape have strength in different aspects of population health and it is critical for buyers to align themselves with the vendors that will meet their requirements.

Other guidance for buyers include:

- Clearly articulate, quantify and document your organization’s business goals and assess the organizations ability to take on population health

- It is critical for buyers to align themselves with the vendors that will successfully meet their requirements

- Remember that a vendors’ strength is typically in its heritage

- Keep in mind that the decision on a vendor is as much a business decision as an IT decision

- Population health management combines payer and provider domain expertise; make sure your vendor has both capabilities

For more information about this report, visit http://www.idc.com/getdoc.jsp?containerId=HI247880\

Image credit: iHealthTran