While digital health and healthcare IT startup funding is accelerating at a record pace, more than half of digital health startups funded between 2008 and 2013 are not likely to survive longer than 20 months, according to a new report from Accenture. The report finds that the imminent rise of these “zombie digital health startups” will lead to larger healthcare companies acquiring these startups to help drive growth by infusing top talent, fueling innovation and bolstering existing solutions.

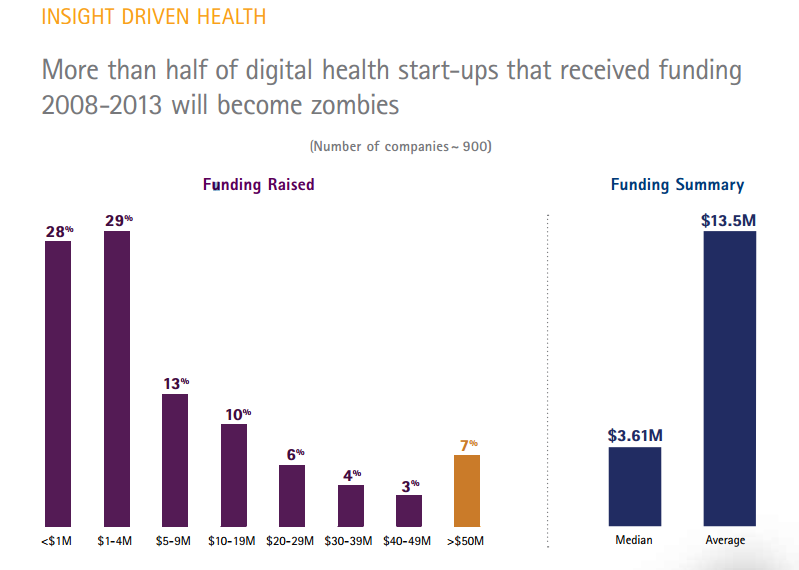

The report, based on an analysis of 900 healthcare IT startups, found that 51 percent were in danger of failing within 20 months of their launch. These “zombie” start-ups – those that are dying but have innovative technology or talent that could benefit a prospective corporate buyer –received nearly $4 billion in start-up funding between 2008 and 2013.

Accenture estimates that digital health start-up funding will reach $6.5 billion by 2017 across four key segments:

1. engagement (25 percent)

2. treatment (25 percent)

3. diagnosis (21 percent)

4. infrastructure (29 percent)

Accenture’s research focused on companies with solutions across social, mobile, analytics, cloud and sensors (SMACS), technologies, which improve clinical and administrative functions and support the development and marketing of diverse and innovative offerings, from wearables/nearables and telehealth to remote monitoring and on-demand services.

3 Benefits of Buying Digital Health Startups

Like “vulture capitalists,” innovative enterprises will swoop in on digital health start-ups to capture relevant and at-theready resources. It is a strategic approach to expand offerings, appeal to the empowered healthcare consumer and move into new digital markets without starting from scratch. Accenture has identified the following top three benefits of buying zombie start-ups:

1. An infusion of top talent. As the healthcare industry evolves, there is a diminishing pool of qualified technical talent with capabilities in emerging areas, and so-called “acqui-hiring” from start-ups can help companies build a bench of top talent quickly – a practice prevalent among many technology companies, such as Apple, Google, Twitter and Yahoo.

When Qualcomm Life acquired HealthyCircles, the company brought on most of the team. As a Qualcomm Life executive explained, “I consider this as much a talent acquisition as a product acquisition.

2. Greater innovation. In a hyper-competitive and saturated market where innovation and competitive differentiation go hand in hand, leading organizations value a more agile and iterative product development cycle, more than ever. There were 1,700 patents between the 900 start-ups that Accenture analyzed, so buying zombie start-ups can initiate and accelerate R&D efforts by capturing intellectual property and patents.

In one such acquisition, St. Jude Medical purchased CardioMEMS, which developed an FDA-approved system that monitors parameters associated with heart failure. St. Jude indicated the acquisition demonstrated its commitment to providing innovative medical device solutions.

3. Bolstering existing solutions. Acquiring digital health start-ups enables healthcare companies to add new products and services that enhance their own solutions. By shopping for a natural fit with a digital health zombie’s products and services, companies can extend asset and capability integration.

For example, Optum acquired a majority interest in Audax Health Solutions to expand its offerings to more broadly support consumers in managing their own health.

“In a period of disruption, leading organizations understand that they cannot keep doing the same things and expect to succeed,” Safavi said. “They must become disruptors instead of being disrupted. Acquiring a failing health IT start-up with excellent people and promising intellectual capital could be just the prescription for achieving that goal” said Kaveh Safavi, managing director for Accenture’s global healthcare business.