Health IT VC funding soared to $1.8 billion in 161 deals in Q2 2014, more than double the $861 million raised in 164 deals in Q1 2014, according to a new Mercom Capital Group report. Ten of those deals were for over $50M each. The $2.6B raised so far this year has already exceeded the $2.2B raised in all of 2013. There were 263 investors that participated in these funding rounds.

Practice-centric companies received 61 percent of all VC investments in Q2 2014, with $1.1B in 61 deals. Consumer-centric companies received $678M in 100 deals, with the majority of the funding going into the Mobile Health category ($401M in 45 deals). There were 38 early-stage deals under $2M in Q2.

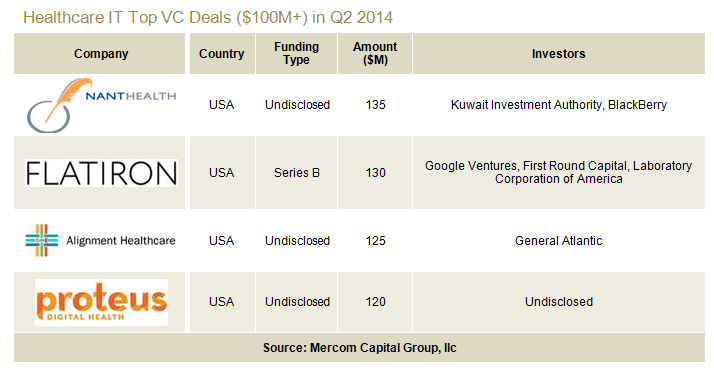

The top VC funding deals over $100M in Q2 were the $135M raise by NantHealth from Kuwait Investment Authority and BlackBerry, the $130M raise by Flatiron Health from Google Ventures, First Round Capital and Laboratory Corporation of America, the $125M raised by Alignment Healthcare from General Atlantic, and the $120M raise by Proteus Digital Health.

Globally, U.S. companies raised $1.6B from 140 of the $1.8B total and 161 deals. Thirteen other countries recorded at least one deal. In the United States, 47 deals came out of California, followed by New York with 12.

There were a record number of merger and acquisition (M&A) transactions in the sector in Q2 2014, with 57 transactions (12 disclosed). Health Information Management companies saw the most M&A activity this quarter with 20 transactions, followed by Revenue Cycle Management and Service Providers with 11 transactions each, and Mobile Health and Personal Health companies with six transactions each.

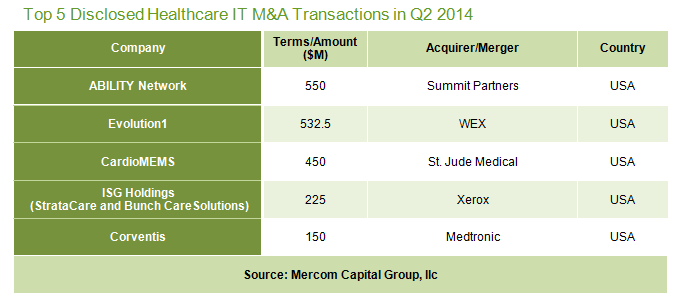

Of the Top 5 M&A transactions, the largest was the $550M leveraged buyout of ABILITY Network by Summit Partners. This was followed by the $532.5M acquisition of Evolution1 by WEX, a provider of corporate payment solutions. St. Jude Medical acquired privately held CardioMEMS for nearly $450M.

Other top disclosed transactions were the $225M acquisition of ISG Holdings by Xerox, followed by the $150M acquisition of Corventis by Medtronic.

There were two Healthcare IT IPOs in Q2, IMS Health and Imprivata, bringing in a combined $1.4B.

Total corporate funding in the Healthcare IT sector, including VC, debt, and public market financing, in Q2 came in at $3.3B.

For the report, visit: http://store.mercom.mercomcapital.com/products-page/healthcare-it-reports/q2-2014-healthcare-it-funding-report/